Voyage Charter : Definition & Full Guide

- By MascotMaritime

- April 22, 2022

- 3 mins read

Table of Contents

What is a voyage charter.

Voyage charter definition : The voyage charter is a contract (voyage charter party) between the shipowner and the charterer wherein the shipowner agrees to transport a given quantity of a shipment, using a pre-nominated vessel for a single voyage from a nominated port (say X) to a nominated port (say Y), within a given time period.

Who is a voyage charterer? What is the freight & voyage charter party?

The person who charters the vessel is called the voyage charterer , the payment is called freight & the contract is called the voyage charter party. The freight rate is calculated as $/tonne of shipment.

What is the most significant part of a voyage charter party?

The most significant parts are the description of the voyage, size & capacity of the vessel, cargo, the allocation of duties and costs in connection with loading and discharging, the specification of the freight, and the payment of the freight, the laytime rules, the allocation of the liability for the cargo and the allocation of other costs and risks.

Depending on the circumstances, other questions and clauses can be very important in the negotiations between the owners and the charterers.

In this type of charter, the vessel must be in the position that the owner specified when the charter was concluded & the vessel must, without undue delay, be directed to the port of loading.

At the port of loading, the charterer must deliver the agreed cargo.

The cargo must not be dangerous cargo unless otherwise agreed. The cargo must be brought alongside the ship at the loading port & must be collected from the ship side at the port of discharge.

Mainly with the bulk cargoes, the charterer often undertakes to pay to load and discharge & often clauses of f.i.o or f.o.b are met. Very often parties agree on f.i.o.s or f.i.o.s.t terms.

In voyage charter, the discharge port need not be nominated in the charter party & in such cases, the charterer must have the right later to direct the vessel within a certain range to a specific port of discharge.

In a voyage charter where the charterer carries out loading &(or) discharging, it is generally agreed that the charterer will have a certain period of time at his disposal for loading & discharging of the vessel & it is called laytime .

If the charterer fails to load and(or) discharge the cargo from the vessel within the laytime, then he has to pay compensation for the extra time used called demurrage . Once in demurrage always in demurrage.

In other cases, if the charterer loads &(or) discharges the cargo from the vessel more quickly than the agreed laytime time, then he is entitled to claim compensation (only if agreed earlier) called despatch money.

In voyage charter, unless lumpsum freight is paid, the owner may claim freight compensation if less cargo is delivered, or cargo is delivered in such a way that ship’s capacity cannot be utilized due to broken stowage . This freight compensation is called deadfreight .

Voyage charter party agreement example:

Click here to see the example of a voyage charter party (NORGRAIN 73).

What are the factors which influence the freight rate in a voyage charter market?

In the voyage charter market, rates are influenced by cargo the charterer must deliver the agreed cargo size, commodity, port dues, and canal transit fees, as well as delivery and redelivery regions.

In general, a larger cargo size is quoted at a lower rate per tonne than a smaller cargo size. Routes with costly ports or canals generally command higher rates than routes with low port dues and no canals to transit.

Voyages with a load port within a region that includes ports where vessels usually discharge cargo or a discharge port within a region with ports where vessels load cargo also are generally quoted at lower rates because such voyages generally increase vessel utilization by reducing the unloaded portion (or ballast leg) that is included in the calculation of the return charter to a loading area.

What are the costs paid by the shipowner & charterer in a voyage charter?

In a voyage charter, the shipowner retains the operational control of the vessel and pays all the operating costs (crew, fuel, freshwater, lubes, port charges, extra insurances, taxes, etc.), with the possible exclusion of the loading/unloading expenses.

The charterer’s costs are usually costs & charges relating to the cargo.

What are the types of voyage charter?

It can be of the following types:

- Immediate – which is carried out within weeks of the contract agreement and the agreed freight rate is called the spot rate.

- Forward – which is scheduled & fulfilled at the agreed time in the future, for example in say three months.

- Consecutive – which refers to several same consecutive voyages.

Related Popular Articles

Criminalization of seafarers – a growing concern.

Criminalization of seafarers is of great concern to the marine transportation industry. It is a growing issue, especially after any maritime accidents or pollution incidents,

Resilience – Insights and strategies for improving seafarers mental health

For seafarers, the challenges of isolation, long working hours and unpredictable conditions can take a toll on their mental health and well being. This article

On Board and Online – Importance of on board connectivity for Seafarers

On Board and Online explores the importance of connectivity and communication in the lives of seafarers and how they contribute to their overall happiness while

One Response

- Pingback: INCOTERMS 2020 : A MUST READ FOR SHIPPING, CUSTOM & LOGISTIC PROFESSIONALS! - MascotMaritime

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Terms & Conditions | Privacy Policy | Disclaimer

World Clock ×

Time Charter vs. Voyage Charter: Understanding the Difference

Oct 9, 2024

Table of Contents

Titledefault.

The maritime industry operates on complex structures and agreements that facilitate the transportation of goods across the globe. Among these agreements, time charter and voyage charter are two of the most significant. Understanding the differences between these two charter types, their importance in shipping, and how a voyage management system like ClearVoyage can streamline operations is essential for shipping companies. In this comprehensive guide, we will explore time charters and voyage charters in detail, discuss their advantages and disadvantages, and highlight how ClearVoyage can enhance efficiency in chartering operations.

What is a Time Charter?

Definition of time charter.

A time charter is a type of charter agreement in which the shipowner leases their vessel to a charterer for a specified period. During this time, the charterer has control over the vessel and its operations but is not responsible for the vessel's crew, maintenance, or management. The shipowner retains ownership and responsibility for the vessel's overall operation.

Key Characteristics of Time Charters

Duration : Time charters are typically for a set period, which can range from months to years.

Flexibility : Charterers can determine the routes and cargo to be transported, allowing for flexible operational planning.

Daily Hire Rate : Charterers pay a daily hire rate, which includes vessel operational costs and crew salaries, among other expenses.

Common Uses of Time Charters

Time charters are often used for:

Long-term Contracts : Companies that need consistent access to shipping services prefer time charters.

Stability : Businesses with predictable shipping needs benefit from the stability offered by time charters.

Operational Control : Companies that want to manage their logistics without purchasing a vessel often opt for time charters.

What is a Voyage Charter?

Definition of voyage charter.

A voyage charter is an agreement where a shipowner leases their vessel to a charterer for a single voyage between specified ports. Unlike time charters, voyage charters do not grant the charterer control over the vessel's operations for an extended period.

Key Characteristics of Voyage Charters

Single Voyage : The charter is specific to one journey, which can include multiple stops.

Freight Rate : Charterers pay a fixed freight rate based on the cargo being transported rather than a daily hire.

Shipowner Control : The shipowner retains control over the vessel's operations, including crew management and maintenance.

Common Uses of Voyage Charters

Voyage charters are commonly used for:

Ad-Hoc Shipments : Companies that have irregular shipping needs benefit from voyage charters.

Spot Market : Charterers looking to take advantage of favorable shipping rates often opt for voyage charters.

Limited Risk : With voyage charters, charterers face less financial risk since they are not tied to long-term contracts.

Time Charter vs. Voyage Charter: The Key Differences

There are key differences when it comes to Time Charters and Voyage Charters. The most important are:

Time Charter : Involves a fixed term that can range from months to years.

Voyage Charter : Limited to a single voyage between specified ports.

Time Charter : The charterer has operational control over the vessel during the charter period.

Voyage Charter : The shipowner retains operational control throughout the voyage.

Payment Structure :

Time Charter : Involves a daily hire rate for the duration of the charter.

Voyage Charter : Utilizes a fixed freight rate based on the cargo being transported.

Flexibility :

Time Charter : Offers flexible routes and the ability to carry different types of cargo during the charter period.

Voyage Charter : Limited to the specified voyage and its associated cargo.

Financial Risk :

Time Charter : Carries a higher commitment and potentially higher costs over the long term.

Voyage Charter : Presents a lower commitment with costs based on individual shipments.

Time Charter : Typically used for long-term contracts, providing stability for shipping companies.

Voyage Charter : More suitable for ad-hoc shipments and operations within the spot market.

Importance of Time Charter Equivalent (TCE)?

Time Charter Equivalent (TCE) is a vital metric in the maritime industry that provides insight into the earnings of a vessel, making it easier to compare different types of charter arrangements, particularly time charters and voyage charters. By calculating TCE, shipowners and operators can assess the financial performance of their vessels in a standardized manner, regardless of the charter type.

Understanding TCE

TCE is essentially a method for calculating a vessel's daily earnings based on its revenue from a voyage, adjusted for expenses and varying operational conditions. It offers a clearer picture of a vessel's profitability by expressing earnings on a daily basis, which facilitates comparisons between different vessels, routes, and charter agreements.

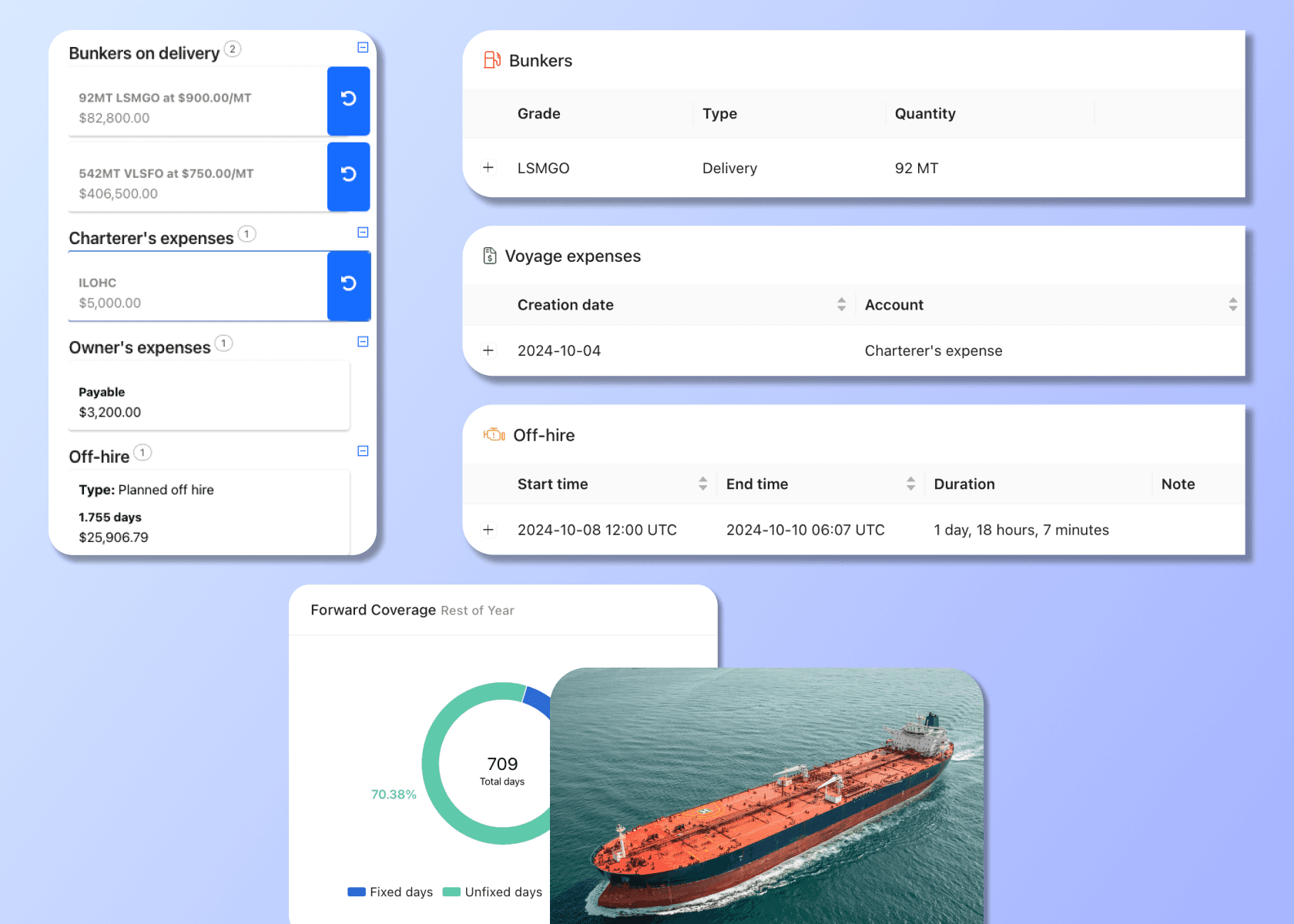

TCE Calculation

To calculate TCE, you can use the following formula:

Total Revenue : This includes all income generated from the charter, such as freight rates.

Total Voyage Costs : This encompasses all expenses related to the voyage, including fuel, port charges, and other operational costs.

Total Days on Hire : This is the total number of days the vessel is chartered for during the voyage.

Example of TCE Calculation

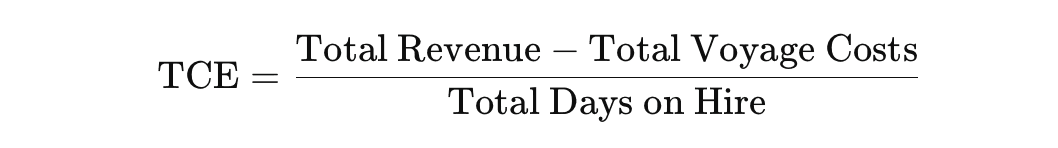

For instance, let’s consider a scenario where a vessel generates $100,000 in freight revenue for a voyage, incurs $30,000 in operational costs, and is on hire for 10 days. The TCE calculation would be as follows:

Total Revenue : $100,000

Total Voyage Costs : $30,000

Total Days on Hire : 10

Plugging these numbers into the formula:

In this example, the Time Charter Equivalent (TCE) for the vessel would be $7,000 per day.

Importance of TCE in Shipping

Standardized Comparison : TCE allows for easy comparison between different vessels and charter types, enabling shipping companies to evaluate performance more effectively.

Financial Planning : By understanding TCE, operators can make informed decisions about chartering strategies, budgeting, and forecasting revenue.

Performance Benchmarking : Shipping companies can use TCE as a benchmark to measure the efficiency and profitability of their operations against industry standards.

Tanker TCE Rates : For tankers, TCE rates can provide crucial insights into the economics of specific routes and cargoes, aiding in strategic planning and operational adjustments.

Integration with Voyage Management : Using a Voyage Management System like ClearVoyage can enhance TCE calculations by integrating real-time data on expenses and revenues, making it easier for operators to manage their financial performance.

Why are Time Charters and Voyage Charters Important?

Importance of time charters.

Predictability : Time charters provide shipping companies with predictable costs and schedules, allowing for better financial planning and budgeting.

Operational Efficiency : Charterers can manage their shipping logistics more effectively by having access to a vessel without the burdens of ownership.

Risk Mitigation : By entering into time charters, companies can reduce the risks associated with market fluctuations and ship maintenance.

Importance of Voyage Charters

Flexibility : Voyage charters offer shipping companies flexibility to respond to changing market demands and specific shipping needs.

Cost-Effectiveness : Companies can avoid the overhead costs associated with long-term contracts, making voyage charters a cost-effective option for irregular shipments.

Market Adaptation : Voyage charters allow companies to quickly adapt to market conditions and fluctuations, providing an advantage in competitive environments.

Advantages and Disadvantages of Time Charters

There are both advantages and disadvantages of time charters.

Advantages of Time Charters

Operational Flexibility : Time charters allow charterers to determine routes and cargo, offering operational flexibility.

Stable Costs : With fixed daily rates, companies can predict and manage shipping costs effectively.

Access to Vessels : Companies can access vessels without the need for ownership, reducing capital expenditure.

Disadvantages of Time Charters

Long-Term Commitment : Time charters often require a long-term commitment, which can be risky if market conditions change.

Higher Costs : The daily hire rate can add up, making time charters more expensive over extended periods.

Management Responsibilities : Charterers may face operational responsibilities that can be burdensome if not managed effectively.

Advantages and Disadvantages of Voyage Charters

There are both advantages and disadvantages of voyage charters.

Advantages of Voyage Charters

Cost-Effectiveness : Voyage charters are typically less expensive than time charters, particularly for irregular shipments.

Lower Risk : Companies face less financial risk as they are not tied to long-term contracts.

Simplicity : Voyage charters are straightforward agreements, making them easier to negotiate and execute.

Disadvantages of Voyage Charters

Limited Control : Charterers have less control over the vessel and its operations compared to time charters.

Market Fluctuations : Companies may face variable costs based on market conditions, making budgeting more challenging.

Potential for Delays : Voyage charters may result in delays or complications during loading or unloading, impacting overall logistics.

How Can a Voyage Management System like ClearVoyage Help?

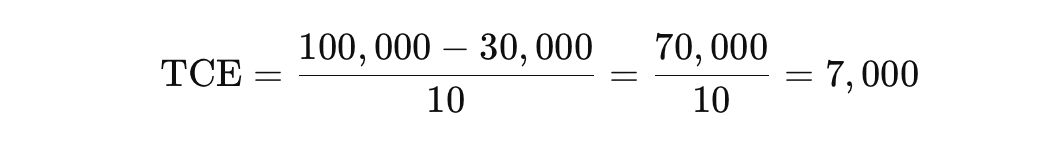

ClearVoyage is an advanced voyage management system designed specifically for shipping operators and owners, enabling them to efficiently manage chartering, operations, and accounting. By integrating various functionalities into a single platform, ClearVoyage empowers shipping companies to streamline their processes, enhance decision-making, and improve overall operational efficiency.

Streamlined Operations

Centralized Information : ClearVoyage allows shipping companies to access vital information about their charters, operations, and financial data in one place. This centralized system eliminates information silos and facilitates better coordination among stakeholders.

Real-Time Tracking : The platform provides real-time updates on vessel availability and performance, enabling companies to make informed decisions and adjust logistics as necessary. With features like live maps and estimated port rotations, users can optimize their voyage planning effectively.

Voyage Estimation : ClearVoyage includes a sophisticated voyage estimator that allows users to calculate costs and revenues accurately. Shipping companies can estimate expenses like fuel consumption and port charges, enabling precise budgeting for each voyage.

Fleet Scheduling : The system maximizes fleet utilization with intelligent scheduling features, reducing idle time and enhancing operational efficiency. Operators can seamlessly integrate scheduling with chartering activities, optimizing fleet performance.

P&L Management : ClearVoyage enables comprehensive profit and loss management tailored for each voyage, providing real-time tracking of earnings and expenses. This helps companies analyze costs, including fuel and port fees, facilitating better financial decision-making.

Enhanced Decision-Making

Performance Analysis : ClearVoyage offers analytical tools that allow shipping companies to evaluate the performance of their charters. By comparing actual versus projected performance, operators can identify areas for improvement and optimize future chartering decisions.

Cost Assessment : The system helps assess the financial implications of various charter types, allowing companies to choose the best option based on their specific operational needs. Users can easily analyze multiple routes and scenarios to determine the most cost-effective solutions.

Market Trends : ClearVoyage can analyze market trends, helping shipping companies anticipate changes in demand and adjust their strategies accordingly. This proactive approach ensures companies remain competitive in the dynamic shipping market.

Improved Communication

Effective communication is crucial in the shipping industry, and ClearVoyage enhances collaboration through several features:

Collaborative Platform : The system allows all stakeholders—including shipowners, charterers, and agents—to collaborate effectively, ensuring everyone is aligned and informed about voyage progress and operational changes.

Alerts and Notifications : ClearVoyage can send alerts and notifications regarding vessel status, charter terms, and critical operational information, enhancing communication among team members and reducing the likelihood of misunderstandings.

Documentation Management : The platform offers a secure repository for storing and sharing important documents, making it easier to manage contracts, invoices, and reports. This streamlines administrative tasks and ensures compliance with contractual obligations.

By leveraging the capabilities of ClearVoyage, shipping companies can effectively navigate the complexities of chartering and operational management, driving efficiency and profitability in their operations. Whether managing time charters or voyage charters, a modern voyage management system like ClearVoyage provides the tools necessary for success in today’s competitive maritime landscape.

In conclusion, understanding the differences between time charters and voyage charters is essential for shipping companies looking to optimize their operations. Each charter type offers distinct advantages and disadvantages, making them suitable for different operational needs. A voyage management system like ClearVoyage can play a pivotal role in streamlining chartering processes, enhancing decision-making, and improving communication among stakeholders.

By leveraging the capabilities of ClearVoyage, shipping companies can navigate the complexities of chartering agreements with ease, ultimately driving efficiency and profitability in their operations. Whether opting for the predictability of time charters or the flexibility of voyage charters, shipping companies can benefit from a comprehensive voyage management system that supports their unique needs and objectives in the ever-evolving maritime industry.

Interested in learning more?

We will talk about your voyage management needs and show you exactly how clearvoyage can meet them.

Book a free demo

- April 30, 2024

Time Charter vs. Voyage Charter: Everything You Need to Know

Navigating maritime logistics demands a robust understanding of chartering options—each type has unique implications for operational strategy and financial outcomes.

Choosing between a time charter and a voyage charter isn’t merely a logistical decision; it’s a strategic one that impacts cost, control, risk management, and operational flexibility.

In this article, we delve deep into the two main types of charters – a time charter and a voyage charter – exploring their advantages and disadvantages, and offering a comparison between the two.

The goal of this article is to:

- equip you with the essential knowledge to navigate these choices

- ensure that your chartering decisions align seamlessly with your business objectives and market conditions

- enhance your company’s competitive edge in the global marketplace.

But before going any further, it’s important to understand the terms used by the industry. Here are the most common:

Time Charter

A time charter grants the charterer the use of a vessel and its crew for a specified period from a shipowner. The ship owner and the charterer will agree on the exact period the lease will run for.

However, the two parties will not need to agree on ports of call and destinations, as the charterer has complete discretion over this. The charterer can direct the vessel’s movements and cargo operations within agreed and imposed contractual limits.

The shipowner retains responsibility for the vessel’s operational aspects, including maintenance (ensuring the vessel meets all necessary maritime safety standards), and crewing, but the charterer must pay for fuel and supply costs, as well as the cost of cargo operations and port charges.

This arrangement is akin to leasing a car, where the lessee drives but doesn’t worry about long-term maintenance. For example, a charterer might lease the ship for six months, during which time they have the flexibility to choose their routes and destinations.

Ship owners generally prefer their vessels to be leased on a time charter. This is because time charters guarantee income for a long period, giving the ship owner increased security.

Voyage Charter

A voyage charter focuses on the transportation of a specific cargo on a single voyage between designated ports.

The most common way to pay for this type of charter is on a per-ton basis. As the name implies, this sees the charterer paying a set price for every ton of cargo they transport and is preferred when the amount of cargo they’re transporting is significantly less than the vessel’s gross maximum cargo tonnage.

The second most common payment method is a lump sum – one payment that allows the charterer to transport as much cargo as they wish. It is the ship owner’s responsibility to ensure the cargo weight does not exceed the gross maximum tonnage of the vessel. This type of payment is preferred by charterers when they’re carrying a higher weight of cargo.

Under this contract, the ship owner is tasked with delivering the cargo and handling all nuances of the voyage itself. Nearly all costs are covered by the ship owner and include costs relating to staffing, berthing, loading, unloading, and fuel. They cover these costs by charging the charterer a fee for leasing the vessel.

Before the charter contract is signed, the parties will agree on the end destination, any ports of call, laytime, and whether there will be any restrictions on cargo. The ship owner pays for all costs at the port of call. If the charterer exceeds the agreed time, they must pay demurrage to the ship owner.

This type of vessel chartering is generally preferred by charterers. This is because it often has more competitive prices, plus they are not tied down to any long-term commitments

Voyage and Time Charters

There are other definitions which are useful to understand.

Charter party

Central to these contracts is the charter party —the formal agreement that stipulates the specific terms, conditions, and obligations agreed upon by the ship owner and the charterer.

This document is crucial as it governs what each party is responsible for, including costs, risks, and how disputes are resolved.

Freight Rates

Freight rates, a critical element of the contract, determine the cost associated with transporting cargo and are influenced by various market conditions and ship specifications.

These rates not only affect the profitability of a voyage but also influence global trade patterns.

Cost Analyses

Cost analysis in this context involves evaluating the expenses related to different chartering options to determine the most cost-effective approach.

This analysis is essential for chartering managers and financial analysts who aim to optimize operational costs against market conditions.

The Statement of Facts (SoF) is an important maritime document that logs vessel activities while in port. It includes times of arrival and departure, cargo handling details, and records of any delays or incidents, providing a factual foundation for operational and legal evaluations.

Freight and Charges

Lastly, understanding freight & charges—the costs incurred during the shipment of cargo—is vital. These charges can vary widely depending on the route, type of cargo, and specific terms of the charter party.

Once again, the use of historical data from SoFs can assist in providing clarity and transparency on these fees.

Advantages and Disadvantages of a Time Charter

Time chartering presents a unique set of advantages and disadvantages that vessel chartering managers, operations VPs, and demurrage cost analysts must weigh carefully when strategizing for optimal operational flexibility and cost efficiency.

Advantages:

- Flexibility in Operations : Time charters offer charterers significant control over the vessel’s employment, including the types and routes of cargoes, as well as one of the most important: access to a vessel. This flexibility is invaluable for adapting to changing market conditions or specific logistical requirements. Using no-code workflows to streamline processes and voyage turnaround simulators can support maritime operations and greatly improve flexibility.

- Cost Predictability : With a fixed daily hire rate, companies can better forecast and manage their shipping expenditures. This predictability aids in budgeting and financial planning, reducing the unpredictability associated with fluctuating freight rates in spot market dealings.

- Reduced Exposure to Market Volatility : During periods of market volatility, time charter arrangements protect the charterer from soaring freight rates, as the hire rate remains constant regardless of market conditions.

Disadvantages:

- Long-term Commitment : One of the primary drawbacks of time charters is the requirement for a longer-term commitment to a vessel. This can be a double-edged sword, especially if market rates fall below the agreed hire rate, potentially leading to higher-than-market operational costs.

- Operational Costs and Risks: While the shipowner handles maintenance and crewing, the charterer is responsible for costs related to the voyage, including fuel, port charges, and other variable expenses.

Charterers should employ proactive cost tracking, negotiate favorable fuel clauses, utilize cost-efficient routing software, and maintain transparent communication with shipowners about anticipated expenses and operational strategies.

For example, a well-prepared and accurate Statement of Facts (SoF ) can provide detailed information about the events that occurred during the time a vessel spent at port.

However, when the opportunity to properly analyze the SoF has not been made available, disputes over ambiguous statements may arise.

On one side, charterers will try to leverage the delays that happened to decrease demurrage. Shipowners, on the other hand, may challenge a charterer’s laytime statement based on the events that are available in the SoF.

Time charters often include terms for demurrage (charges when the charterer uses the vessel beyond the agreed period) and dispatch (rewards for completing operations early). The SoF provides the necessary data to calculate these charges or rewards accurately, documenting the exact time spent during loading and unloading.

- Lesser Control Over Maintenance : Charterers have limited control over the maintenance and condition of the vessel, relying on the shipowner to maintain standards. Poor maintenance can affect cargo schedules and overall shipping efficiency.

Maintenance of the vessel can also have a direct effect on the charterer due to new emissions regulations.

Keeping track of current changes in maritime emissions regulations is a challenging task. With so many initiatives and new norms being implemented, trying to provide frameworks to capture and report on emissions, makes the topic extremely complex for operators, shipowners, and commodity manufacturers.

Advantages and Disadvantages of Voyage Charter

Voyage charters represent a different approach compared to time charters, focusing on specific trips rather than extended periods. This method suits operations that require precise cargo deliveries without long-term ship commitment, but it also carries its own set of pros and cons.

- Direct Cost Association : The major appeal of voyage charters lies in their direct cost association with individual voyages. The charterer is not liable for any costs, except the initial charter fee, and is not responsible for finding a crew. Charterers pay per trip, making it easier to allocate costs directly to specific cargoes or projects.

- No Long-Term Commitment or Contract: Unlike time charters, voyage charters do not require a long-term commitment to a vessel, providing flexibility to switch between ships and routes as dictated by cargo needs or market conditions.

- High Control Over Cargo Operations : Charterers maintain extensive control over the loading and unloading processes, ensuring that handling aligns with their standards and schedules. This is particularly beneficial for sensitive or high-value cargoes.

- Vulnerability to Market Fluctuations : While time charters protect against market volatility, voyage charters expose charterers to fluctuating freight rates. During peak times, costs can escalate significantly, affecting overall profitability and a lack of flexibility for the charterer.

- Inconsistent Costs (and higher initial costs): The costs in voyage charters can vary widely from one trip to another, influenced by factors like fuel prices, port fees, and canal dues. This inconsistency makes budgeting and financial planning more complex.

For example:

a. Exceeding laytime – the time allowed for loading and unloading cargo at ports – can lead to demurrage charges. Having a well-prepared SoF ensures that the arrival, cargo operations, and departure times are documented, which are key data points for laytime calculations.

b. New emissions regulations leading to the use of specific fuels or ship adjustments may soon be passed on to charterers via higher freight costs. For many ships, technical modifications may be the only realistic way to attain the required certifications and to be under the emissions limit, impacting the commercial operation of the vessel.

- Dependency on Ship Availability : Charterers are at the mercy of market availability. During periods of high demand, finding suitable vessels can be challenging and more expensive, potentially leading to delays and increased operational risks.

How to Choose Between Time Charter and Voyage Charter: Factors to Consider

Choosing between a time charter and a voyage charter is a strategic decision that hinges on several criteria to be weighed carefully to align with organizational objectives and the dynamic nature of the maritime industry.

Here we present six criteria that every chartering manager or analyst should consider.

- Duration and Frequency of Cargo Needs

Consider the length and frequency of your shipping needs.

Time charters are more suitable for longer and more regular shipping requirements, providing stability and predictability. These agreements are signed only for a limited period, without providing any specified route to the other party. Throughout this charter period, the Charterer can use the vessel for trading on the recognized trade routes without restrictions.

On the other hand, voyage charters are ideal for single, occasional, or irregular shipments. These contracts are signed for carrying a particular quantity of goods on the preset by the two parties. They also are obliged to carry the stated commodity onboard between pre-decided ports only. After the said trip is completed, the contract is automatically terminated.

- Market Conditions and Freight Rate Volatility

The current and anticipated market conditions play a crucial role. In a volatile market with rising freight rates, a time charter might lock in a more favorable rate for a longer period.

Conversely, in a stable or declining market, voyage charters might offer more cost-effective and flexible options.

- Operational Control

Evaluate the level of control you need over the vessel’s operation.

Time charters offer more control over the vessel’s itinerary and operations, beneficial for complex logistics operations.

Voyage charters provide control over the cargo but less so over the vessel’s operations.

- Financial Planning, Profitability, and Budget Constraints

Assess your financial flexibility

Time charters require a substantial and consistent financial commitment, which is predictable but potentially higher in the long term.

Time charters provide more predictable cash flow due to fixed daily hire rates, which can be advantageous in a volatile market as they protect against rate increases.

However, they may result in negative cash flow if the market rates decrease significantly below the charter rate agreed upon, as the charterer still must pay the fixed rate.

Voyage charters , while potentially more variable in cost, do not require long-term financial commitments and can be adjusted according to budgetary needs. The absence of a long-term commitment allows companies to avoid the financial drain of a non-performing asset, which is possible in a time charter if market conditions worsen.

Typically, payments in voyage charters are tied to specific milestones, such as loading or unloading completion, which can help in planning cash flow.

- Cargo Specificity and Handling Requirements

Consider the nature of the cargo. Special handling requirements, sensitivity, and value of the cargo might dictate the need for more direct control over handling processes, favoring voyage charters.

- Risk Tolerance

Finally, analyze your company’s risk tolerance.

Time charters minimize exposure to market fluctuations but involve commitment risks . They provide more predictable cash flow due to fixed daily hire rates, which can be advantageous in a volatile market as they protect against rate increases. However, they may result in negative cash flow if the market rates decrease significantly below the charter rate agreed upon, as the charterer still must pay the fixed rate.

Voyage charters offer flexibility but expose the charterer to market rate risks and operational uncertainties. Profitability and effectiveness in managing cash flow depend on the charterer’s ability to manage and mitigate risks associated with market volatility and operational uncertainties.

By automating manual workflows with available low-code technology , companies can save and reduce risk while maintaining data integrity and real-time visibility of their voyages’ most essential KPIs.

To reduce risk, dedicated software to automatically assign tasks and notify stakeholders prevents constant back and forth through emails or updating of spreadsheets can be implemented. Stakeholders can be given dedicated access to track their inbound shipments, schedule changes, and collect documents.

If you want the lowest possible ongoing costs, the clear winner is the voyage charter.

Why? Because they don’t require a long-term contract. They do have a higher initial cost, but this is offset by the fact that no other significant fees need to be paid, in general.

But, when it comes to the initial cost of chartering a ship, it’s nearly always going to be cheaper to go with a time charter.

A ship owner is more open to a lower price, as they know you’ll be hiring the vessel for longer. What’s more, you, and not the ship owner, will be expected to cover other costs, pushing the initial price down further. As the vessels are leased for long periods, the vessel can be used to travel anywhere, without restriction.

In making your final decision, engage with stakeholders, including operations managers, financial analysts, and logistics coordinators, to understand the full implications of each option.

Besides, using a holistic approach to evaluate these factors will guide you toward the most strategic chartering decision for your specific circumstances.

Related news

Designed for Charterers

EXPLORE THE

Voyager tour.

Four Stowaways Survive Dangerous 2,000 NM Trip On Rudder Of Container Ship, Arrested

German Navy Warships Take Much Longer Route To Avoid Red Sea Amid Houthi Attacks

Navigation Error Led To Sinking Of Royal Malaysian Navy Vessel On Stork Reef, Killing 1

Nuclear-Powered LNG Carriers Promise Faster & Emission-Free Future For Shipping

Voyage charter vs time charter.

Ships, boats and other recreational vessels are owned by a large number of individuals who often purchase them as assets. They do not use these vessels for shipping goods or for ferrying passengers.

Instead, they often lend them out to third party organizations who use them for a variety of purposes. In maritime legal terms, this lending process is known as chartering. Chartering is an important concept of the global maritime trade sector, and is of different types.

This article will delve into the differences between two specific categories of charters – the voyage charter and the time charter.

What is a Charter?

A charter is an agreement between two or more groups known as charter parties, regarding the leasing of a vessel for a fixed set of conditions. The terms and conditions stipulated in the charter are binding on all the parties in the agreement and covers a wide variety of clauses and possible scenarios that may arise. It is considered to be an official document in legal aspects and is required by Admiralty Law to be drawn up in case of any form of vessel hiring or leasing.

A shipowner is the first party in the charter agreement who owns the vessel under consideration. The charterer is an individual or organization who is in need of a ship.

The charterer may have cargo that he wishes to transport, or may further lease out the vessel to third parties.

The shipbroker is a link between ship owners and charterers, and aids in finalizing the terms of the agreement. The terms of the agreement include the duration of leasing, fees, payment instalments, regulations on usage, and detailed surveyor reports on the condition of the ship.

Payment is termed as a freight rate and is remitted to the shipowner at fixed intervals decided in the agreement.

Surveyor reports are important in chartering, as they ensure that the vessel is seaworthy prior to being chartered. Similarly, on completion of a charter agreement, and before final payment formalities, another survey report is conducted to ensure that the vessel has sustained no damage during the lease period.

The charter agreement lays down the responsibilities of each group and stipulates the condition in which the vessel is to be maintained.

There are three main types of charters – voyage charter, time charter, and demise charter.

The demise charter is often known as a bareboat charter, and grants ownership or possession of the vessel to the charterer subject to certain time-bound conditions.

Terms and Features of a Voyage Charter

A voyage charter is a type of charter in which a vessel is leased out for a particular voyage. The charter agreement lists the ports of call, destination, and restrictions on cargo, if any.

Most voyage charters are undertaken by charterers who have cargo that needs to be shipped. For this, they contact ship owners through brokers and arrange a ship for a particular voyage.

Payment of voyage charters can be done in two methods – on a per-ton basis, or on a lump-sum basis .

The per-ton basis involves paying the owner for every ton of cargo or freight transported on the vessel. This is preferred when the cargo tonnage is considerably lower than the gross maximum cargo tonnage of the vessel.

On the other hand, when a higher weight of the cargo is carried, it is advisable to pay on a lump-sum basis . The shipowner must ensure that the tonnage carried on board the vessel is within the acceptable limits of the ship. This includes checking the tonnage of on-deck cargo, and the various load lines of the vessel.

There are some important terms used in a contract agreement, that lays out the time-based rules to be followed for the duration of the contract.

Laytime refers to the time that a charterer is allowed to complete the loading and unloading process at a port of call. Since the owner pays duties and berthing charges at the port, they expect the charterer to hasten the process.

In case the charterer exceeds the laytime laid out in the contract, he is obliged to pay a penalty known as demurrage . This covers the extra costs incurred by the shipowner owing to the delay by the charterer.

On the other hand, if the ship is able to complete the loading and unloading operations before the stipulated time, the charterer can claim payment of a despatch from the owner. This is often seen as an incentive for charterers to complete the port operations as soon as possible.

In voyage chartering, the shipowner undertakes payment of fuel, operation, and employment-related costs. It is their responsibility to hire the officers and other crew members for the voyage either from a pool of individuals working for them, or using brokers as middlemen to source mariners and seafarers.

In addition, the owner must also pay costs such as berthing and loading operations. Any equipment used must also be paid for by the owners.

To recoup these costs, the owners charge a higher rate from the charterer. In general, charterers transporting a one-off consignment prefer voyage charters despite the high cost. This is because they are not tied down to the contract for a long period of time.

Simply put, a voyage charter involves a charterer hiring a vessel for the purpose of a single voyage, in which the route and ports have been pre-determined. The responsibility of duty and other payments along with recruitment is handled completely by the shipowner, while the cargo is the sole responsibility of the charterer.

Terms and Features of a Time Charter

A time charter is a time-bound agreement, as opposed to a voyage charter. The shipowner leases a vessel to a charterer for a fixed period of time, and they are free to sail to any port and transport any cargo, subject to legal regulations.

Although the charterer controls the ship, the maintenance of the vessel still falls under the purview of the owner. They are responsible for ensuring that the vessel meets internationally accepted maritime standards, throughout the course of the agreement. They regularly employ marine surveyors to prepare reports on the seaworthiness of the vessel and make repairs as and when required. The owner will face legal action in case the vessel is found to have some major problem.

The time charter agreement can span anywhere from a few days to a few years. This is a long-term agreement that works on a single rate of payment known as the freight rate.

Payment is to be remitted every quarter and does not fluctuate under ordinary circumstances.

In time chartering, the charterer is responsible for selecting a crew, paying charges that arise during the voyages, and arranging for provisions to ensure smooth operations at every port of call. They must intimate the planned route to the owners in advance. The payment is calculated on a per-day basis, with penalties added at a later time. The cost of fuel, provisions etc. are to be covered by the charterer, while the owner will handle all maintenance-related costs.

The charterer often does not sail on the vessel and provide instructions to the master of the vessel in their stead. This includes permissible cargo, route and ports, required charter speed etc.

Unlike voyage charters that use a rigid payment calculation, there are several provisions for unforeseen delays in time charters.

Since payment is on a daily basis, the charterer may be delayed for a certain reason, and these are covered in the agreement.

Time not included in the final payment is known as off-hire hours . For instance, if a vessel is slowed down because of poor weather that could not have been predicted, the extra time spent is not included in the final time count.

Similarly, if some form of damage occurs and repairs need to be carried out, the duration is considered to be off-hire . Certain clauses can be inserted in the agreement, that allows for a fixed number of off-hire hours. Beyond this, the charterer is charged for delays.

Briefly put, a time charter involves leasing a vessel for a fixed period, on a per-day rate, where the charterer is free to use the vessel. The owner only looks after maintenance-related cost.

Clauses are inserted to protect the charterer from having to pay for hours that were spent due to events that could not have been foreseen.

How to Choose a Charter Type

Voyage and time charters are very different, in their intended use and service conditions. Knowing when to choose each type of charter can go a long way in meeting expectations of the charterer and shipowner.

A voyage charter is preferred in cases where the charterer only needs the vessel for specific voyages that may arise for different reasons. This could be the case when there is an occasional cargo to transfer.

An occasional cargo commonly springs up during sudden surges in demand, when the supply services are down. Thus, companies that may deal in other commodities may enter the cargo industry for that period of time, in order to make a profit.

This can also happen when the charterer has already pressed into service their own fleet of vessels, which forces them to hire a ship from a third party so that they may undertake a single voyage.

Voyage chartering can be tricky for inexperienced charterers, since the matter of the crew and equipment must be handled correctly.

Most owners make arrangements to look after these requirements, but it is mostly based on goodwill. Having a shipbroker negotiate the terms can be very helpful in ensuring that the occasional charterer is not inconvenienced by having a ship without a crew to man it.

A time charter is more commonly used by more experienced chartering firms when there is a long-term requirement for a vessel. Instead of having to specify the ports and routes undertaken by the vessel in the charter agreement, the charterer simply hires the boat for a fixed period of time and takes complete control over the vessel in all but name.

As they are free to sail to any destination with any group of crew and officers, it is beneficial to companies that already deal in shipping. For instance, if a ship is decommissioned or is sent in for repairs, the company needs to be able to procure a vessel for the duration of that period.

Instead of having to book a ship every time they wish to undertake a voyage, they use time charters. Thus, for the duration of the agreement, they will have possession of the vessel and are free to use it, within the purview of the law. This is especially useful since such a charterer will often already have a crew ready to take over the hired vessel.

Another major factor that sways the decision to pick either a voyage or time charter is the finances of the shipping industry. Voyage chartering is considered to be a volatile market since there is no assurance of leasing a boat on completion of an existing contract. Since it is only applicable for a single voyage, the overall volatility of the voyage charter is high.

However, charterers prefer voyage charters for the reason that they can always get a more competent rate from other ship owners. In other words, the owners are at the mercy of the chartering sector.

So, most ship owners prefer time charters, as it guarantees financial returns for a fixed period of time, at a fixed rate. This offers some protection against rapid fluctuation of the chartering rates. However, charterers do not prefer this contract, as it ties them down at a single rate for an extended period.

A one-off charterer always goes for a voyage charter, while a regular charterer prefers time charters. Shipowners are often directly approached by charterers, instead of having marine brokers. Thus, one must have an overall look at various factors influencing the shipping sector, prior to choosing between a voyage and time charter.

Overall Comparison

Table of responsibilities.

You may also like to read –

- 8 Main Factors that Affect Ocean Freight Rates

- What is the Difference between Lay days and Lay time?

A Beginners Guide To Maritime Law

- Maritime principles and regulations for International trade

- Important for shipping companies, seafarers and shore staff

- Read Instantly

- 2 FREE Bonuses

- Guaranteed For 30 Days

Disclaimer : The information contained in this website is for general information purposes only. While we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

About Author

Ajay Menon is a graduate of the Indian Institute of Technology, Kharagpur, with an integrated major in Ocean Engineering and Naval Architecture. Besides writing, he balances chess and works out tunes on his keyboard during his free time.

Read More Articles By This Author >

Do you have info to share with us ? Suggest a correction

Daily Maritime News, Straight To Your Inbox

Sign Up To Get Daily Newsletters

Join over 60k+ people who read our daily newsletters

By subscribing, you agree to our Privacy Policy and may receive occasional deal communications; you can unsubscribe anytime.

BE THE FIRST TO COMMENT

Great article that provides lots of fundamental knowledge! Kudos to the author, thank you!

@Edward: Glad you liked it 👍

Leave a Reply

Your email address will not be published. Required fields are marked *

Subscribe to Marine Insight Daily Newsletter

" * " indicates required fields

Marine Engineering

Marine Engine Air Compressor Marine Boiler Oily Water Separator Marine Electrical Ship Generator Ship Stabilizer

Nautical Science

Mooring Bridge Watchkeeping Ship Manoeuvring Nautical Charts Anchoring Nautical Equipment Shipboard Guidelines

Explore

Free Maritime eBooks Premium Maritime eBooks Marine Safety Financial Planning Marine Careers Maritime Law Ship Dry Dock

Shipping News Maritime Reports Videos Maritime Piracy Offshore Safety Of Life At Sea (SOLAS) MARPOL

Voyage Charter vs Time Charter – Everything You Need to Know

Voyage Charter vs Time Charter – Everything you need to know.

One of the biggest questions facing a charterer is whether to opt for a voyage charter or a time charter. Evaluating voyage charter vs time charter can be a complex process, but we’ve broken everything down on this page, making it easier for charterers to decide which type of vessel chartering is best for them.

1. What is a Charter? 2. What is a Voyage Charter? 3. Voyage Charter Features/Terms 4. Voyage Charter Pros & Cons 5. What is a Time Charter? 6. Time Charter Features/Terms 7. Time Charter Pros & Cons 8. How to Choose a Charter Type 9. Charter Cost 10. Ongoing Cost 11. Flexibility 12. Contract Length 13. Convenience 14. FAQs About Voyage Charter and Time Charter 15. Conclusion

What is a Charter?

A voyage charter and a time charter are two options commonly found in the chartering business. A voyage charter is when the charterer leases a vessel for a specific voyage, such as Dubai to Singapore, while a time charter is a type of lease that allows the charterer use of the vessel for a specific period of time.

As you might imagine, there are many differences between these two types of charters, and both vessel chartering options have their own pros and cons. Keep on reading this page about voyage charter vs time charter to find out which of the two options will be most suitable for your ship chartering requirements.

Voyage Charter

What is a voyage charter.

A voyage charter is a type of ship chartering that sees the charterer agree to lease the vessel for one specific voyage. So, for example, the agreement might be for the charterer to gain use of the charter ship for a journey from Dubai to Dover.

Features/Terms

As just mentioned, a voyage charter is when a charterer leases a vessel for one voyage. Before the charter contract is signed, the parties will agree on the end destination, any ports of call, and whether there will be any restrictions on cargo. Once signed, the charterer must not deviate from any of these agreements.

The terms and conditions of the charter agreement will also stipulate the laytime permitted. The laytime refers to the amount of time it takes for the vessel to be loaded and unloaded. As the ship owner pays for all costs at the port, they need this process to be as quick as possible. If the charterer exceeds the agreed time, they must pay demurrage to the ship owner. Conversely, the ship owner will usually refund some money if the loading and unloading is quicker than stipulated.

But who is responsible for what costs? Well, with a voyage charter, nearly all costs are covered by the ship owner. These include costs relating to staffing, berthing, loading, unloading, and fuel. They cover these costs by charging the charterer a fee for leasing the vessel.

The amount of money paid by the charterer can be determined in two ways. The most common way to pay is on a per-ton basis. As the name implies, this sees the charterer paying a set price for every ton of cargo they transport. This is preferred by charterers when the amount of cargo they’re transporting is significantly less than the vessel’s gross maximum cargo tonnage.

The other payment type is a lump sum – one payment that allows the charterer to transport as much cargo as they want to. It is the ship owner’s responsibility to ensure the cargo weight does not exceed the gross maximum tonnage of the vessel. This type of payment is preferred by charterers when they’re carrying a higher weight of cargo.

This type of vessel chartering is generally preferred by charterers. This is because it often has more competitive prices, plus they are not tied down to any long-term commitments.

Pros & Cons

Pro: Charterer not liable for any costs, except initial charter fee Pro: Incentives to complete port operations quickly Pro: No need to find a crew Pro: No long-term contract

Con: Lack of flexibility for charterer Con: Higher initial charter fee

Time Charter

What is a time charter.

A time charter is a type of vessel chartering that sees the charterer lease the ship for a set period of time. So, they might lease the ship for two months, during which time they have the flexibility to choose their own routes and destinations.

Before anything is signed, the ship owner and the charterer will agree the exact period of time the lease will run for. Unlike with voyage charters, the two parties will not need to agree on ports of call and destinations, as the charterer has complete discretion over this.

With a time charter, the ship owner does not cover all costs. Instead, the charterer must pay for fuel and supply costs, as well as the cost of cargo operations. However, the charterer won’t have to pay such a large charter fee, which balances things out somewhat. The owner is still required to pay for the crew and ongoing maintenance, and also must ensure the vessel meets all necessary maritime safety standards.

It is generally the case that the charterer will pay for hire in advance, on a per-day basis. Payment is not usually made in one lump sum, with the charterer instead paying the lease charge in set instalments, which are usually quarterly. It’s important to note that, should the ship be held up in unforeseen circumstances, such as inclement weather, the lost time – referred to as off-hire hours – will not usually be charged for, although if too many off-hire hours are accrued, the charterer might end up being liable.

Ship owners generally prefer their vessels to be leased on a time charter. This is because time charters guarantee income for a long period of time, giving the ship owner increased security.

Pro: Guarantees charterer access to a vessel Pro: Initial lease cost is lower Pro: More flexibility for the charterer

Con: Several ongoing costs to pay Con: Tied down to long-term contract

How to Choose a Charter Type

We’ve discussed voyage charter vs time charter above, looking at the various pros and cons of each. But which should you choose when looking to charter a ship?

Well, this really depends on your requirements. We’ve broken things down into five sections – charter cost, ongoing costs, flexibility, contract length, and convenience – and will let you know which of the ship chartering options is better for each one.

Charter Cost

When it comes to the initial cost of chartering a ship, it’s nearly always going to be cheaper to go with a time charter. This is because the ship owner will be more amenable to a lower price, as they know you’ll be hiring the vessel for longer. What’s more, you, and not the ship owner, will be expected to cover other costs, pushing the initial price down further.

So, if you’re looking for the lowest possible upfront cost, the best option is a time charter. However, remember that other costs will also need to be paid.

Ongoing cost

If you choose to take out a time charter, you will have to pay several costs, including fuel and supply costs. With voyage charters, the only significant cost payable is the initial charter – all other major expenses are covered by the ship owner.

Therefore, if you want the lowest possible ongoing costs, the clear winner is the voyage charter. However, the upfront cost will be more expensive than a time charter.

Flexibility

Those who sign up for a voyage charter are limited in their movements, as they will have already agreed a set route with the ship owners. Those who have taken a time charter have far more freedom, as they can choose where to go throughout their charter.

This clearly means that those looking for more flexibility should opt for a time charter, as there are no limitations on route, ports of call, and destinations.

Contract Length

With a time charter, you’re tied into a long contract, committing you to ongoing payments. Voyage charters, on the other hand, only last for the duration of the voyage, meaning voyage charters are generally much shorter than time charters.

This all means that those looking for the shortest contract should opt for a voyage charter. However, if you know you’ll constantly need an available vessel, the long contract of a time charter could be more suitable.

Convenience

There will be no need to hire and pay a crew when opting for either the time charter or the voyage charter. It’s only bareboat charters that require the charterer to hire and pay their own crew. However, the ongoing costs associated with time charters can be inconvenient.

Overall, voyage charters are the more convenient of the two options, as there’s no need to organise payment for such things as port costs and fuel. However, both options are generally far more convenient than a bareboat charter.

FAQs About Voyage Charter and Time Charter

What are BIMCO Sanctions Clause for Voyage Charter Parties 2020?

These are intended to help in two scenarios. Firstly, if one of the signatories of the agreement gets sanctioned, the other signatories will be able to end the contract and claim damages. Secondly, when the trade or activity is subject to or becomes subject to sanctions, the ship owners can refuse to perform their contracted duties.

What is the difference between bill of lading and charter party vs time and voyage charter?

A charter party is an agreement between charterer and ship owner to lease a ship. A bill of lading is an agreement that legally obligates the charterer to carry cargo that has been loaded aboard the ship.

A time charter is a type of vessel chartering whereby the ship owner leases the ship for a set length of time. A voyage charter is a type of vessel chartering whereby the ship owner leases the ship for the duration of a specific voyage.

What are the duties and responsibilities of the ship owner and charterer under a time charter and voyage charter party?

Under a voyage charter, the ship owner assumes almost all responsibility, including hiring and paying crew, and paying for all significant costs associated with the journey. The charterer simply has to pay the ship owner a fee to secure their vessel.

With time charters, ship owners must still hire and pay staff. However, most other significant costs associated with a voyage, such as fuel and port fees, must be paid by the charterer.

Why do ship owners prefer voyage charter over time charter?

Quite simply, they don’t. Ship owners usually prefer time charters, as they ensure that their ship is guaranteed to be chartered for a longer period, generating income throughout.

Voyage charters are short, meaning the ship owner must continually find new charterers to lease the vessel to – something that isn’t always possible. When a new charterer can’t be found, the ship owner loses money.

Please note that charterers are required to take out insurance for both types of charter, to cover them against damage, injury, marine salvage , and more.

Those looking for short-term charters are best served by opting for a voyage charter, as these don’t require a long contract to be signed. They do have a higher initial cost, but this is offset by the fact that no other significant fees need to be paid.

However, those who know they’ll regularly require the use of a vessel might be better off with a time charter, as these see vessels leased for a long period of time. During this time, the vessel can be used to travel anywhere, without restriction. Time charters cost less upfront, but require the charterer to pay various other costs, such as the cost of fuel and port fees.

Have you found this page to be helpful? If so, please share it on social media! Also, feel free to leave a comment below!

DEXTER OFFSHORE LTD

Mazaya Business Avenue – BB2- 1403 – First Al Khail St – Dubai, United Arab Emirates Tel: +971 04 430 8455

MORE INFORMATION

Contact Us About Us Meet Our Team QHSE Policy

CONNECT WITH US

LinkedIn Facebook Instagram YouTube

Types of Charter Agreements: Time, Voyage, and Bareboat

Types of Charter Agreements: Time, Voyage, and Bareboat. In the intricate web of the maritime industry, charter agreements are the threads that connect shipowners and charterers, facilitating the movement of goods across the world’s oceans. These agreements come in various forms, each tailored to specific needs and circumstances. Among the most common types of charter agreements are time charters, voyage charters, and bareboat charters. In this article, we will delve into the details of these three fundamental charter types, exploring their characteristics, benefits, and when to use them.

1. Time Charter:

A time charter agreement is a widely employed arrangement in the maritime industry. In this type of charter, the shipowner leases their vessel to the charterer for a defined period, typically ranging from a few months to several years. During the charter period, the charterer gains operational control of the vessel, including selecting the ports of call and determining the cargoes to be transported.

Key Aspects of Time Charters:

– Operational Control: While the charterer assumes operational control, the shipowner retains ownership of the vessel. The shipowner provides and maintains the crew, and the charterer is responsible for covering the vessel’s operating expenses, including crew wages, fuel, and maintenance.

– Flexibility: Time charters offer flexibility to both parties. Charterers can adapt to changing market conditions and cargo requirements, while shipowners can secure steady revenue over the charter period.

– Revenue Structure: The charterer pays the shipowner a fixed daily rate, known as “hire,” for the vessel’s use. This rate is typically negotiated and agreed upon in advance. The charterer may also pay additional voyage-related expenses.

– Types of Cargo: Time charters are suitable for various types of cargo and are often used for transporting bulk commodities, such as coal, grains, and minerals, as well as containerized goods.

2. Voyage Charter

A voyage charter agreement, as the name suggests, is focused on a specific voyage or journey. In this arrangement, the shipowner provides the vessel to the charterer for a single voyage, from a designated port of loading to a port of discharge. Voyage charters are ideal for one-time cargo movements or irregular routes.

Key Aspects of Voyage Charters:

– Single Voyage: Unlike time charters, which cover an extended period, voyage charters are limited to a single voyage. Once the cargo is delivered, the charter agreement is completed.

– Freight Charges: The charterer pays freight charges based on the cargo’s weight or volume and the distance traveled. The shipowner remains responsible for all operating costs.

– Flexibility: Voyage charters offer flexibility to charterers, allowing them to choose specific vessels and routes for each voyage based on market conditions and cargo requirements.

– Cargo Variety: Voyage charters are commonly used for transporting a wide range of cargo, from raw materials to finished goods. They are particularly useful for cargo with specific loading and discharge locations.

3. Bareboat Charter (Demise Charter)

A bareboat charter, also known as a demise charter, represents a unique arrangement in which the charterer gains complete control and responsibility for the vessel. In this type of charter, the shipowner effectively transfers ownership to the charterer for the duration of the agreement.

Key Aspects of Bareboat Charters:

– Full Control: The charterer assumes full operational control of the vessel, including crewing, maintenance, and navigation. The shipowner is no longer involved in the vessel’s day-to-day operations.

– Ownership Transfer: During the charter period, the vessel is treated as if it were owned by the charterer. This includes registering the vessel under the charterer’s flag.

– Purchase Option: Bareboat charter agreements often include an option for the charterer to purchase the vessel at the end of the charter period. This option provides a clear path to ownership for the charterer.

– Specialized Use: Bareboat charters are common for specialized vessels, such as offshore platforms, drilling rigs, and research vessels.

Choosing the Right Charter Type:

Selecting the appropriate charter type depends on several factors, including the nature of the cargo, the duration of the transportation need, and the desired level of control. Time charters provide flexibility and steady revenue, voyage charters are ideal for one-time shipments, and bareboat charters offer full control and potential ownership.

In the dynamic world of maritime commerce, understanding these charter agreements is crucial for shipowners, charterers, and maritime professionals to make informed decisions that align with their specific goals and operational requirements. Each charter type serves a unique purpose, contributing to the intricate tapestry of global trade and logistics.

Related Articles

Why and How I Became Sailor, Which I Never Thought To

Read this interesting story of a guy who tells how and why he became sailor even though he never planned to join one. Let’s read this one. Born and brought up in Defence family I was influenced a lot by jets flying day and night above our Air force quarters back when I was a […]

Ship Energy Efficiency Management Plan Trilogy- Part 1, 2 and 3

Title: Navigating Sustainability: The Ship Energy Efficiency Management Plan (SEEMP) Trilogy The maritime industry is embarking on a voyage towards a more sustainable and environmentally responsible future. At the helm of this journey lies the Ship Energy Efficiency Management Plan (SEEMP), a comprehensive framework that consists of three interconnected parts: SEEMP Part 1, SEEMP Part […]

IMU CET 2023 important dates

IMU CET 2023 important dates are mentioned in this article and students are requested to go through them thoroughly, so that they don’t miss out on anything which is important nature. All dates are taken from the official brochure of the IMU CET. IMU CET 2023 important dates- For all events Timeline for admissions to […]

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Cambridge Dictionary +Plus

Meaning of voyage charter in English

Your browser doesn't support HTML5 audio

Examples of voyage charter

Word of the Day

(in films and television) a series of drawings or images showing the planned order of images

Making the most of it (How we talk about using opportunities)

Learn more with +Plus

- Recent and Recommended {{#preferredDictionaries}} {{name}} {{/preferredDictionaries}}

- Definitions Clear explanations of natural written and spoken English English Learner’s Dictionary Essential British English Essential American English

- Grammar and thesaurus Usage explanations of natural written and spoken English Grammar Thesaurus

- Pronunciation British and American pronunciations with audio English Pronunciation

- English–Chinese (Simplified) Chinese (Simplified)–English

- English–Chinese (Traditional) Chinese (Traditional)–English

- English–Dutch Dutch–English

- English–French French–English

- English–German German–English

- English–Indonesian Indonesian–English

- English–Italian Italian–English

- English–Japanese Japanese–English

- English–Norwegian Norwegian–English

- English–Polish Polish–English

- English–Portuguese Portuguese–English

- English–Spanish Spanish–English

- English–Swedish Swedish–English

- Dictionary +Plus Word Lists

- Business Noun

- All translations

To add voyage charter to a word list please sign up or log in.

Add voyage charter to one of your lists below, or create a new one.

{{message}}

Something went wrong.

There was a problem sending your report.

Voyage Charter

A Voyage Charter is a contractual agreement between a shipowner and a charterer to transport goods on a specific voyage.

A Voyage Charter is a maritime contract between a shipowner (or charterer) and a cargo owner, specifying the terms and conditions for hiring a vessel for a particular voyage. A voyage charter agreement outlines details such as freight rates, cargo quantities, loading and discharge ports, laytime, and demurrage, providing a framework for transporting goods by sea.

A voyage charter agreement defines the responsibilities and obligations of both parties involved, including the shipowner's commitment to transport the specified cargo and the charterer's agreement to pay the agreed-upon freight rates.

Key elements of a Voyage Charter include:

- Freight Rates: The amount agreed upon for the transportation of the cargo, usually calculated based on the quantity of cargo or the space occupied on the vessel.

- Loading and Discharge Ports: The ports where the cargo will be loaded onto the vessel and subsequently discharged.

- Laytime: The agreed period during which the charterer is allowed to load and unload the cargo without incurring additional charges.

- Demurrage: Charges applicable if the loading or unloading takes longer than the agreed laytime.

Latest Blog Updates

DiMuto Partners with Portcast to Elevate Real-time Visibility for Agritrade Shipments

DiMuto's partnership with Portcast improves agri-trade logistics through AI-powered real-time tracking, ensuring freshness and quality for perishable goods while boosting supply chain transparency.

Detention and Demurrage: New FMC Regulations and the Role of Visibility in Reducing D&D Fees

Learn how the new FMC regulations and real-time visibility solutions help shippers and forwarders reduce costly detention and demurrage (D&D) fees by improved tracking and proactive planning.

The Montreal Port Strike: Impacts on Container Shipping and Supply Chains

Understand the impact of the Montreal port strike on container shipping and supply chains, plus access a live spreadsheet of vessels likely affected by the strike.

Make Your Supply Chains Seamless and Efficient

- Ship Charter Rates

- Ship Bunker

- Chartering News

- Chartering Lessons

Pros and Cons of Voyage Charter

Voyage Charter Pros

Voyage Charter provides a flexible means by which a ship can be provided for the carriage of a specific cargo between two specific ports. To this extent it will provide cover for a cargo interest’s short-term requirement to move cargo from X to Y.

Additionally, a shipowner can provide short-term employment for the ship by engaging them on voyage charters.

Many shipowners operating fleets of ships will employ ships in this way in order to balance their portfolio of work. A number of ships from the fleet will be operated on long-term time charters to provide a steady income stream for the shipowners.

The remaining proportion of the fleet will be employed on Voyage Charters in order to allow the shipowners to benefit from fluctuations in the market price for ships caused by shortages of ships.

In this way Voyage Charters provide a flexible solution to the intrinsically variable demands of shipping.

A voyage charter is a type of charter party in the shipping industry where a shipowner agrees to transport a specific quantity of cargo for a set price from one or more ports to one or more destinations. Like any contractual arrangement, voyage charters come with their own set of advantages and disadvantages:

Pros of Voyage Charter

- Defined Costs for Charterers : In a voyage charter, the cost of transporting goods is agreed upon in advance. This allows the charterer to know the exact cost of transportation, aiding in budgeting and financial planning.

- No Ship Operating Costs for Charterers : The shipowner bears all the operating costs of the ship, including fuel, crew, maintenance, and insurance. This is beneficial for the charterer as they are not exposed to these variable expenses.

- Efficiency in Cargo Transportation : Voyage charters are often the most efficient way to transport large quantities of cargo over long distances, making them ideal for bulk and commodity shipments.

- Flexibility in Cargo Handling : The charterer has some flexibility in specifying loading and unloading procedures, which can be tailored to the nature of the cargo.

- Market Opportunities for Shipowners : Voyage charters allow shipowners to capitalize on favorable market conditions, setting higher freight rates when demand is high.

- No Long-Term Commitment for Charterers : Voyage charters are typically for a single voyage, offering charterers flexibility without the need for a long-term commitment, as opposed to time charters which can last for several months or years.