- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

11 Best Travel Insurance Companies in November 2024

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If the past few years have shown us anything, it’s that travelers need to be prepared for the unexpected — from a pandemic to flight troubles to the crowded airport terminals so many of us have encountered.

If you don't have sufficient travel insurance coverage via your credit card , you can supplement your policies with third-party plans.

Whether you’re looking for an international travel insurance plan, emergency medical care or a policy that includes extreme sports, these are the best travel insurance providers to get you covered.

How we found the best travel insurance

We looked at quotes from various companies for a 10-day trip to Mexico in September 2024. The traveler was a 55-year-old woman from Florida who spent $3,000 total on the trip, including airfare.

On average, the price of each company’s most basic coverage plan was $126.53. The costs displayed below do not include optional add-ons, such as Cancel For Any Reason coverage or pre-existing medical condition coverage.

Read our full analysis about the average cost of travel insurance so you can budget better for your next trip.

However, depending on the plan, you may be able to customize at an added cost.

As we continue to evaluate more travel insurance companies and receive fresh market data, this collection of best travel insurance companies is likely to change. See our full methodology for more details.

Best insurance companies

Types of travel insurance

What does travel insurance cover, what’s not covered, how much does it cost, do i need travel insurance, how to choose the best travel insurance policy, what are the top travel destinations in 2024, more resources for travel insurance shoppers.

Top credit cards with travel insurance

Methodology

Best travel insurance overall: berkshire hathaway travel protection.

Berkshire Hathaway Travel Protection

- ExactCare Value (basic) plan is among the least expensive we surveyed.

- Speciality plans available for road trips, luxury travel, adventure activities, flights and cruises.

- Company may reimburse claimants faster than average, including possible same-day compensation.

- Multiple "Trip Delay" coverage types might make claims confusing.

- Cheapest plan only includes fixed amounts for its coverage.

Under the direction of chair and CEO Warren Buffett, Berkshire Hathaway Travel Protection has been around since 2014. Its plans provide numerous opportunities for travelers to customize coverage to their needs.

At $135 for our sample trip, the ExactCare Value (basic) plan from Berkshire Hathaway Travel Protection offers protection roughly $10 above the average price.

Want something cheaper? Air travelers looking for inexpensive, less comprehensive protections might opt for a basic AirCare plan that includes fixed amounts for its coverage .

Read our full review of Berkshire Hathaway .

What else makes Berkshire Hathaway Travel Protection great:

Pre-existing medical condition exclusion waivers available at nearly all plan levels.

Plans available for travelers going on a cruise, participating in extreme sports or taking a luxury trip.

ExactCare Value (basic) plan was among the least expensive we surveyed.

Best for emergency medical coverage: Allianz Global Assistance

Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Global Assistance is a reputable travel insurance company offering plans for over 25 years. Customers can choose from a variety of single and annual policies to fit their needs. On top of comprehensive coverage, some travelers might opt for the more affordable OneTrip Cancellation Plus, which is geared toward domestic travelers looking for trip protections but don’t need post-departure benefits like emergency medical or baggage lost.

For our test trip, Allianz Global Assistance’s basic coverage cost $149, about $22 above average.

What else makes Allianz Global Assistance great:

Annual and single-trip plans.

Plans are available for international and domestic trips.

Stand-alone and add-on rental car damage product available.

Read our full review of Allianz Global Assistance .

Best for travelers with pre-existing medical conditions: Travel Guard by AIG

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

Travel Guard by AIG offers a variety of plans and coverages to fit travelers’ needs. On top of more standard trip protections like trip cancellation, interruption, baggage and medical coverage, the Cancel For Any Reason upgrade is available on certain Travel Guard plans, which allows you to cancel a trip for any reason and get 50% of your nonrefundable deposit back as long as the trip is canceled at least two days before the scheduled departure date.

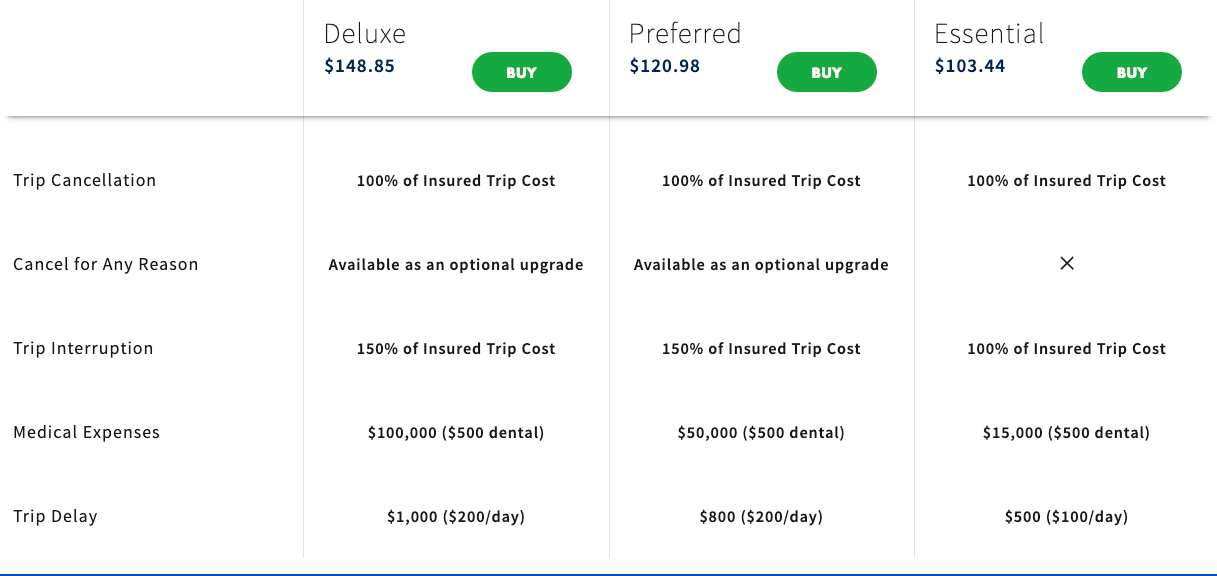

At $107 for our sample trip, the Essential plan was below average, saving roughly $20.

What else makes Travel Guard by AIG great:

Three comprehensive plans and a Pack N' Go plan for last-minute travelers who don't need cancellation benefits.

Flight protection, car rental, and medical evacuation coverage, as well as annual plans available.

Pre-existing medical conditions exclusion waiver available on all plan levels, as long as it's purchased within 15 days.

Read our full review of Travel Guard by AIG .

Best for those who pack expensive equipment: Travel Insured International

Travel Insured International

- Higher-level plan include optional add-ons for event tickets and for electronic equipment

- Rental car protection add-on for just $8 per day, even on lower-level plan.

- Many of the customizations are only available on the higher-tier plan.

- Coverage cost comes in above average in our latest analysis.

Travel Insured International offers several customization options. For instance, those going to see a show may want to add on event ticket registration fee protection. Traveling with expensive gear?Consider adding on coverage for electronic equipment for up to $2,000 in coverage.

Be sure to check which policies are available in your state. You will need to input your destination, residence, trip dates and the number of travelers to get a quote and see coverages.

What else makes Travel Insured International great:

Comprehensive plans include medical expense reimbursement accidents, sickness, evacuation and pre-existing conditions, depending on the plan.

Flight plans include coverage for missed and canceled flights and lost or stolen baggage.

Read our full review of Travel Insured International .

Best for adventurous travelers: World Nomads

World Nomads

- Travelers can extend coverage mid-trip.

- The standard plan covers up to $300,000 in emergency evacuation costs.

- Plans automatically cover 200+ adventurous activities.

- No Cancel For Any Reason upgrades are available.

- No pre-existing medical condition waivers are available.

Many travel insurance plans contain exclusions for adventure sports activities. If you plan to ski, bungee jump, windsurf or parasail, this might be a plan to consider.

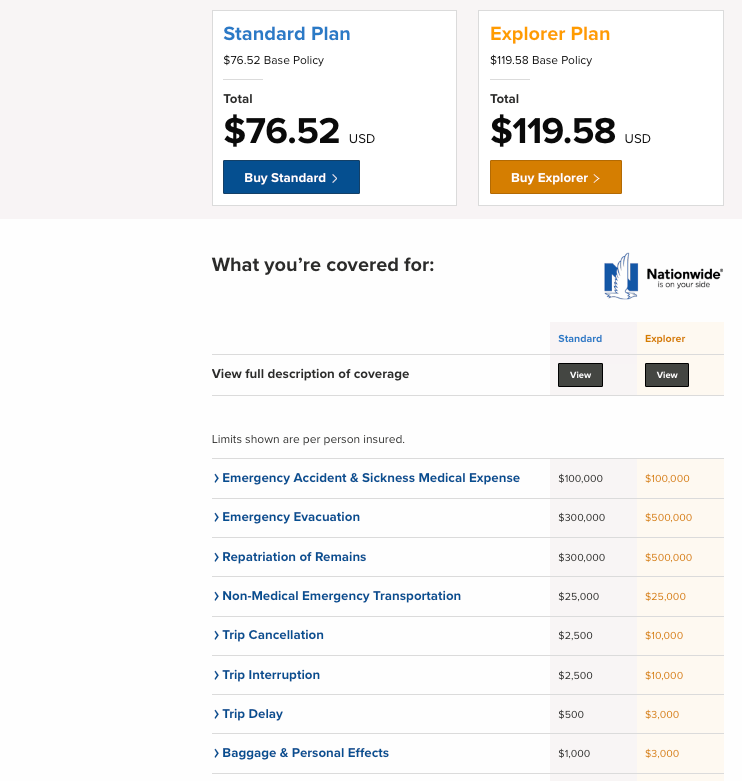

Note that the Standard plan ($72 for our sample trip), while the most affordable, provides less coverage than other plans. But it can be a good choice for travelers who are satisfied with trip cancellation and interruption coverage of $2,500 or less, do not need rental car damage protection, find the limits to be sufficient and do not need coverage for certain more adventurous activities.

What else makes World Nomads great:

Comprehensive international travel insurance plans.

Coverage available for adventure activities, such as trekking, mountain biking and scuba diving.

Read our full review of World Nomads .

Best for medical coverage: Travelex Insurance Services

Travelex Insurance Services

- Top-tier plan doesn’t break the bank and provides more customization opportunities.

- Offers a plan specifically for domestic travel.

- Sells a post-departure medical coverage plan.

- Fewer customization opportunities on the Basic plan.

- Though perhaps a plus for domestic travelers, keep in mind the Travel America plan only covers domestic trips.

For starters, basic coverage from Travelex Insurance Services came in at $125, almost exactly average for our sample trip.

Travelex’s plans focus heavily on providing protections that are personalized to your travel style and trip type.

While the company does offer comprehensive plans that include medical benefits, you can also choose between cheaper plans that don’t provide cancellation coverage but do offer protections during your travels.

Read our full review of Travelex Insurance Services .

What else makes Travelex Insurance Services great:

Three comprehensive plans available, two of which cover international trips.

Offers a post-departure plan geared exclusively toward disruptions after you leave home.

Two flight insurance plans available.

Best if you have travel credit card coverage: Seven Corners

Seven Corners

- Annual, medical-only and backpacker plans are available.

- Cancel For Any Reason upgrade is available for the cheapest plan.

- Cheapest plan also features a much less costly Interruption for Any Reason add-on.

- Offers only one annual policy option.

Each Seven Corners plan offers several optional add-ons. Among the more unique is a Trip Interruption for Any Reason, which allows you to interrupt a trip 48 hours after the scheduled departure date (for any reason) and receive a refund of up to 75% of your unused nonrefundable deposits.

» Jump to the best cards with travel insurance

The basic coverage plan for our trip to Mexico costs $124 — right around the average.

What else makes Seven Corners great:

Comprehensive plans for U.S. residents and foreigners, including travelers visiting the U.S.

Cheap add-ons for rental car damage, sporting equipment rental or trip interruption for any reason.

Read our full review of Seven Corners .

Best for long-term travelers: IMG

- Coverage available for adventure travelers.

- Offers direct billing.

- Claim approval can be lengthy.

While some travel insurance companies offer just a handful of plans, with IMG, you’ll really have your pick. Though this requires a bit more research, it allows you to search for coverage that fits your travel needs.

However, travelers will want to be aware that IMG’s iTravelInsured Travel Lite is expensive. Coming in at $149.85, it’s the costliest plan on our list.

Read our full review of IMG .

What else makes IMG great:

More affordable than average.

Many plans to choose from to fit your needs.

Best for travelers with unpredictable work demands: Tin Leg

- In addition Cancel For Any Reason, some plans offer cancel for work reason coverage.

- Adventure sports-specific coverage is available.

- Plans have overlap that can be hard to distinguish.

- Only one plan includes Rental Car Damage coverage available as an add-on.

Tin Leg’s Basic plan came in at $134 for our sample trip, adding about $8 onto the average basic policy cost. Note that you’ll pay a lot more if you shop for the most comprehensive coverage, and there are eight plans to choose from for trips abroad.

The multitude of plans can help you find coverage that fits your needs, but with so many to choose from, deciding can be daunting.

The only real way to figure out your ideal plan is to compare them all, look at the plan details and decide which features and coverage suit you and your travel style best.

Read our full Tin Leg review .

Best for booking travel with points and miles: TravelSafe

- Covers up to $300 redepositing points and miles on eligible canceled award flights.

- Optional add-on protection for business equipment or sports rentals.

- Multi-trip or year-long plans aren’t available.

Selecting your travel insurance plan with TravelSafe is a fairly straightforward process. The company’s website also makes it easy to visualize how optional add-on elements influence the total cost, displaying the final price as soon as you click the coverage.

However, at $136, the Basic plan was among the more expensive for our trip to Mexico.

What else makes TravelSafe great:

Rental car damage coverage add-on is available on both plans.

Cancel For Any Reason coverage available on the TravelSafe Classic plan.

Read our full TravelSafe review .

Best for group travel insurance: HTH Insurance

HTH Travel Insurance

- Covers travelers up to 95 years old.

- Includes direct pay option so members can avoid having to pay up front for services.

- A 24-hour delay is required for baggage delay coverage on the TripProtector Economy plan.

- No waivers for pre-existing conditions on the lower-level plan.

HTH offers single-trip and multitrip medical insurance coverage as well as trip protection plans.

At around $125, the Trip Protector Economy policy is at the average mark for plans we reviewed.

You can choose to insure group trips for educators, crew, religious missionaries and corporate travelers.

What else makes HTH Insurance great:

Medical-only coverage and trip protection coverage.

Lots of options for group travelers.

Read our full review of HTH Insurance .

As you shop for travel insurance, you’ll find many of the same coverage categories across numerous plans.

Trip cancellation

This covers the prepaid costs you make for your trip in cases when you need to cancel for a covered reason. This coverage helps you recoup upfront costs paid for flights and nonrefundable hotel reservations.

Trip interruption

Trip interruption benefits generally involve disruptions after you depart. It helps reimburse costs incurred for flight delays, cancellations and plenty of other covered disruptions you might encounter during your travels.

This coverage can cover the costs for you to return home or reimburse unexpected expenses like an extra hotel stay, meals and ground transportation.

Trip delay coverage helps cover unexpected costs when your trip is delayed. This is another coverage that helps offset the costs of flight trouble or other travel disruptions.

Note that many policies have a total amount a traveler can claim, with caps on per diem benefits, too.

Cancel For Any Reason

Cancel For Any Reason coverage allows you to recoup some of the upfront costs you paid for a trip even if you’re canceling for a reason not otherwise covered by your standard travel insurance policy.

Typically, adding this protection to your plan costs extra.

Baggage delay

This coverage helps cover the costs of essential items you might need when your luggage is delayed. Think toiletries, clothing and other immediate items you might need if your luggage didn’t make it on your flight.

Many travel insurance plans with baggage delay protection will specify how long (six, 12, 24 hours, etc.) your luggage must be delayed before you can make a claim.

Lost baggage

Used for travelers whose luggage is lost or stolen, this helps recoup the lost value of the items in your bag.

You’ll want to make sure you closely follow the correct procedures for your plan. Many plans include a maximum total amount you can claim under this coverage and a per-item cap.

Travel medical insurance

This covers out-of-pocket medical costs when travelers run into an emergency.

Because many travelers’ health insurance plans don’t cover medical care overseas, travel medical insurance can help offset out-of-pocket health care costs.

In addition to emergency medical coverage, many plans have medical evacuation or repatriation coverage for costs incurred when you must be taken to a hospital or return to your home country because of a medical situation.

Most travel insurance plans cover many trip protections that can help you be prepared for unexpected travel disruptions and expenses.

These coverages are generally aimed at protecting the money you put into your trip, expenses you incur because of travel trouble and costs incurred if you have a medical emergency overseas.

On top of core coverages like trip cancellation and interruption and travel medical coverage, some plans offer add-on options like waivers for pre-existing conditions, rental car collision damage waivers or adventure sports riders. These usually cost extra or must be added within a specified timeframe.

Typical travel insurance policies offer coverage for many unforeseen events, but as you research to select a plan, consider your needs. Though every plan differs, there are some commonly excluded coverages.

For instance, you typically can’t get coverage for a named storm if you bought the coverage after the storm was named. In other words, if you have a trip to the Caribbean booked for Sept. 25 and on Sept. 20 a hurricane develops and is named, you generally won’t be able to buy a travel insurance plan Sept. 21 in hopes of getting your money back.

Many plans also don’t cover activities performed under the influence of drugs or alcohol or any extreme sports. If the latter applies to you, you might want to consider a plan with specific coverages for adventure-seekers.

For numerous plans, a few other situations don’t qualify as an acceptable reason to cancel and make a claim, such as fear of travel, medical tourism or pregnancies (unless you booked a trip and bought insurance before you became pregnant or there are complications with the pregnancy). This is where a Cancel For Any Reason add-on to your coverage can be helpful.

You can also run into trouble if you give up on a trip too soon: a minor (or even multihour) flight delay likely isn’t sufficient to cancel your entire trip and get reimbursed through your plan. Be sure to review what requirements your specific plan has when it comes to canceling a trip, claiming trip interruption, etc.

Travel insurance costs vary widely. The final price of your plan will fluctuate based on your age, length of trip and destination.

It will also depend on how much coverage you need, whether you add on specialized policies (like Cancel For Any Reason or pre-existing conditions coverage), whether you plan to participate in extreme sports and other factors.

In our examples above, for instance, the 35-year-old traveler taking a $2,000 trip to Italy would have spent an average $76 for a basic plan to get coverage for things like trip cancellation and interruption, baggage protection, etc. That’s a little less than 4% of the total trip cost — lower than average.

If there were multiple members in a traveling party or if they were going on, say, a rock-climbing or bungee-jumping excursion, the costs would go up.

On average, travel insurance comes to about 5% to 10% of the trip cost. However, considering many of the plans reimburse up to 100% of the trip cost (or more) for disruptions like trip cancellation or interruption, it can be a worthwhile expense if something goes wrong.

It depends. Consider the following factors that might affect your decision: You’re young and healthy, all your bookings are refundable or cancelable without a penalty, your flights are nonstop, you’re not checking bags and a credit card you carry offers some travel protections . In that case, travel insurance might not be necessary.

On the other hand, if you prepaid a large chunk of money for a nonrefundable African safari, you’re going on a Caribbean cruise in the middle of a hurricane season or you’re going somewhere where the cost of health care is high, it’s not a bad idea to buy a travel insurance plan. Here’s how to find the best travel insurance coverage for you.

If you’re thinking of booking a trip and not planning to buy travel insurance, you may want to consider at least booking refundable airfare and not prepaying for hotel, rental car and activity reservations. That way, if something goes wrong, you can cancel without losing any money.

Selecting the best travel insurance policy comes down to your needs, concerns, preferences and budget.

As you book, take a few minutes to consider what most concerns you. Is it getting stranded because of flight trouble? Having the ability to cancel for any reason you see fit without losing money? Getting sick or injured right before departure and needing to postpone the trip? Injuring yourself or falling ill while overseas?

Ultimately, you want a plan that protects you, your money and the large investment in your trip — but doesn’t cost too much, either.

Medical coverage. If your priority is having adequate medical coverage abroad, you might want to look for plans with high limits for medical emergencies and medical evacuation.

Complex travel itinerary. If your itinerary has lots of flight connections, prepaid hotels and deposits for activities you can’t get back, prioritizing a plan with the best coverage for trip cancellations or interruptions may land at the top of your list.

Travel uncertainty. If you’re on the fence about a trip and have nonrefundable reservations, you may want to select a plan with a Cancel For Any Reason coverage option, which can help you recoup about 50% to 75% of the costs. This helps provide peace of mind, placing the decision on whether to travel entirely in your hands.

Car rentals. If you’re renting a car, a collision damage waiver is often worth looking into.

The following destinations are the top insured destinations in 2024, according to Squaremouth (a NerdWallet partner).

The Bahamas.

Costa Rica.

Antarctica.

In 2022, travelers spent about 25.53% more on trips than they did before the pandemic.

As of December, NerdWallet analysis determined travel prices are 10% higher than pre-pandemic. Each statistic makes a strong case for protecting your travel investment as you plan your next trip.

Bookmark these resources to help you make smart money moves as you shop for travel insurance.

What is travel insurance?

CFAR explained.

Is travel insurance worth getting?

10 credit cards that provide travel insurance.

We used the following factors to choose insurance providers to highlight:

Breadth of coverage: We looked at how many plans each company offered plus the range of their standard plans.

Depth of coverage: We considered two data points to get a sense of how much each company pays out for common travel issues — the maximum caps for trip cancellation and trip interruption claims.

Cost: By looking at the costs for basic coverage across multiple companies, we determined an average cost for shoppers to benchmark plan prices against.

Customizability: While standard plans can cover a lot of ground, sometimes you need something a little more personal.

Customer satisfaction. Using data from Squaremouth when available, and Google Reviews as a backup, we can give kudos to companies with better track records from their clients.

No, it doesn’t necessarily get more expensive the longer you wait to purchase. However, as you put off buying insurance, you may lose access to potential plans and coverage options.

In general, buying travel insurance within a few days to two weeks of prepaying or making an initial deposit for your trip is your best bet. Assuming you’re not booking last-minute, this will provide you with access to the widest possible range of coverage options. It also helps prevent any medical conditions or storms that pop up between booking and buying a plan from ending up as excluded situations, which won’t be covered by your plan.

But, generally, many plans do allow you to buy coverage quite close to your departure date.

To get the most out of your travel insurance plan, buy it soon after making your initial prepayment or deposit to ensure you have access to the biggest menu of plans possible.

Select a plan that’s comprehensive enough to cover the travel scenarios you’re most concerned about or likely to encounter but not too expensive or laden with protections you’d never likely need.

Whatever your coverage, thoroughly review the plan so you understand what’s covered and what’s not, plus how to adhere to the plan’s rules for making a claim.

Travelers frequently use phrases like “trip insurance” and “travel insurance,” as well as “trip protection,” interchangeably, but they do mean different things, according to Stan Sandberg, founder of insurance comparison site TravelInsurance.com.

Trip insurance, or trip protection, generally refers to predeparture (or preevent) coverage if you need to cancel. You may see these plans sold by airlines, online travel agencies or even ticketed event sellers.

“You could refer to it as the portion that protects the investment in the trip,” Sandberg says.

A travel insurance plan typically includes that — plus more comprehensive benefits to protect you during your trip, from medical coverage to trip delay and lost baggage protections, and many more elements, depending on the plan.

Though travel insurance is typically not required for international trips, your personal circumstances will play a key role in whether it’s a good investment.

For instance, young, healthy travelers with few prepaid trip expenses embarking on a relatively risk-free trip may not see a need to buy a plan.

Older travelers with complicated itineraries who are visiting destinations where they could potentially fall ill or get injured — or who could encounter bad weather or some other disrupting factor along the way — may want to buy coverage.

Consider a few key questions:

How well would your health insurance plan cover you if you needed to visit a hospital overseas?

How much did you prepay for a hotel or rental car?

How much money would you be out if weather or some other flight issue derailed your itinerary?

Could you afford an unexpected night in a city where you have a connecting flight?

Do you already have a credit card that provides some travel protections?

Your answers to these questions can help you decide whether you need travel insurance for your international trip.

In general, buying travel insurance

within a few days to two weeks of prepaying or making an initial deposit

for your trip is your best bet. Assuming you’re not booking last-minute, this will provide you with access to the widest possible range of coverage options. It also helps prevent any medical conditions or storms that pop up between booking and buying a plan from ending up as excluded situations, which won’t be covered by your plan.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

[Limited Time] New Cardholders Can Get up to $1,050 in Chase Travel℠ Value

Chase Sapphire Preferred® Card

✈️ Our Nerds say it's "nearly a must-have for travelers " because of its big sign-up bonus, high-value points and money-saving perks like hotel credit and rental car insurance.

🤑 Better yet, it's offering one of the best bonuses ever right now, only for a limited time...

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best Annual Travel Insurance Plans of 2024

Allianz Travel Insurance »

AIG Travel Guard »

Seven Corners »

GeoBlue »

Trawick International »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Annual Travel Insurance Plans.

Table of Contents

- Allianz Travel Insurance

- AIG Travel Guard

Buying travel insurance can be a smart move for most trips, but those who travel more than a few times a year should consider an annual travel insurance policy. Whether you regularly travel for business and/or take several vacations a year, annual travel insurance plans can help you get the coverage you need without having to price out and purchase protection every time you leave home.

If you find yourself in a situation where an annual plan makes sense, know that not all travel insurance companies offer this kind of coverage. You'll also want to consider the available annual travel insurance plans to see which options make sense for your travel style and the level of coverage you want.

Frequently Asked Questions

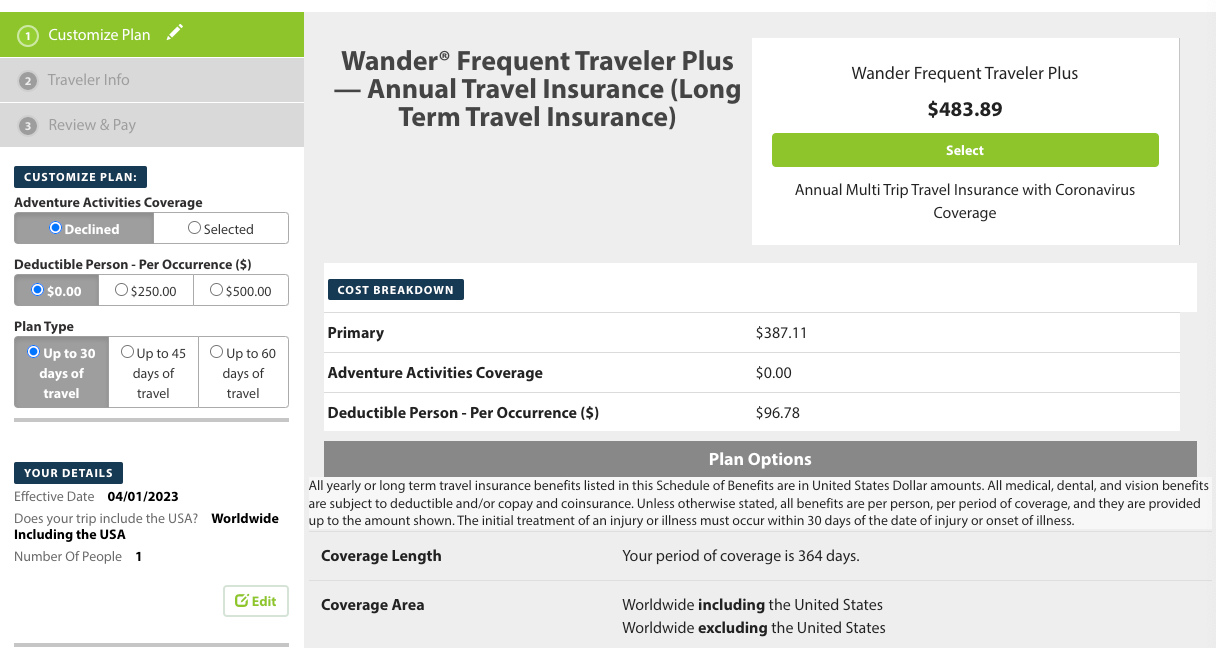

Annual travel insurance plans all work in their own way, but the majority let travelers pay one annual premium for coverage that lasts for up to 364 days. These plans often limit the length of individual trips that are covered within the coverage year. Per-trip and annual limits on coverage can also apply.

In some cases, annual travel insurance plans require a deductible or coinsurance for certain types of coverage. If you're considering an annual travel insurance plan because you take multiple trips each year, make sure you read over the policy details and understand all coverage limits and trip limits that apply.

The cost of annual travel insurance typically varies based on factors like the age of the travelers applying, included benefits and coverage limits. You will want to shop around to compare plans across multiple providers using a platform like TravelInsurance.com or Squaremouth before you settle on a travel insurance policy.

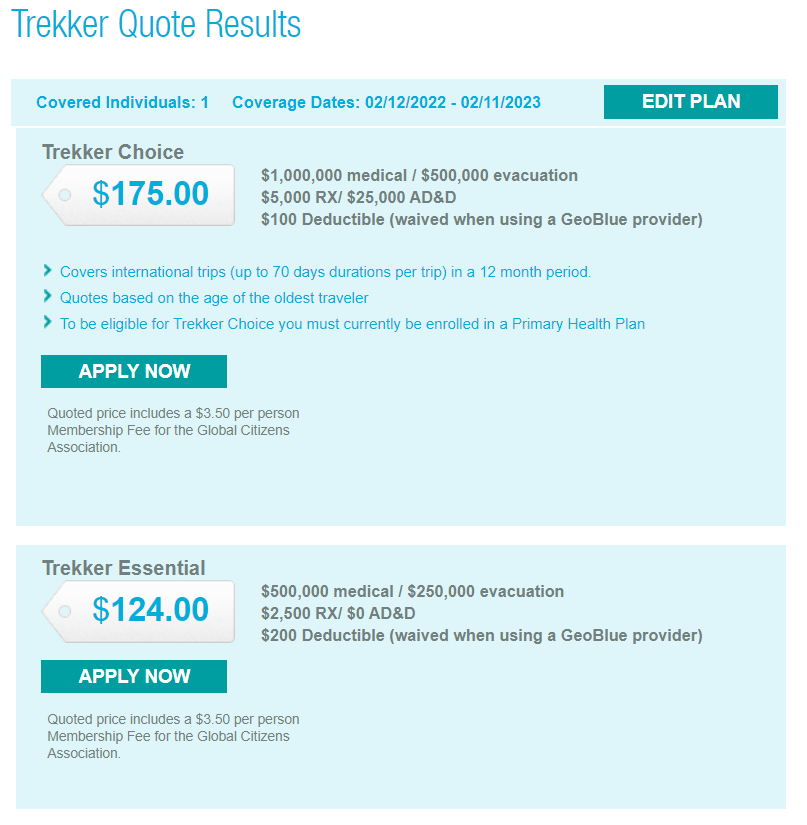

To provide an example of the cost of annual travel insurance, U.S. News applied for a quote for two 40-year-old travelers seeking coverage for eight trips over a 12-month period. The Squaremouth travel insurance portal quoted policies with costs that range from $206 for the GeoBlue Trekker Essential plan to $610 for the Safe Travels Annual Deluxe plan by Trawick International.

Annual travel insurance can be worth it if you take multiple trips each year and want to make sure you always have coverage in place. After all, the alternative to having a multitrip policy is buying a new travel insurance plan for every vacation you take. That's not always feasible for frequent travelers who are always jetting off somewhere new – often at the last minute.

Just keep in mind that annual travel insurance plans tend to come with lower coverage limits than plans for single trips, and that you'll pay a premium for coverage that comes with comprehensive benefits and high limits for medical expenses and emergency evacuation.

- Allianz Travel Insurance: Best Overall

- AIG Travel Guard: Best for Basic Coverage

- Seven Corners: Best for Medical

- GeoBlue: Best for Expats

- Trawick International: Best for the Cost

Tailor your annual travel insurance plan to your needs

Most plans include coverage for trip cancellation and interruption, travel delays, medical expenses, and more

Lowest-tier plans (AllTrips Basic and AllTrips Prime) come with no or relatively low coverage limits for trip cancellation

Most annual plans (except for AllTrips Premier) do not cover trips longer than 45 days

- Trip cancellation coverage worth up to between $2,000 and $15,000

- Trip interruption coverage worth up to between $2,000 and $15,000

- Emergency medical coverage worth up to $50,000

- Up to $500,000 in emergency medical transportation coverage

- Up to $2,000 in coverage for lost or damaged baggage

- Up to $2,000 in coverage for baggage delays

- Travel delay coverage worth up to $1,500 ($300 daily limit)

- Rental car coverage worth up to $45,000

- Up to $50,000 in travel accident coverage

- 24-hour hotline assistance and concierge service

SEE FULL REVIEW »

Annual Travel Insurance Plan offers year-round travel insurance protection

Relatively high limits for medical expenses ($50,000) and emergency evacuation ($500,000)

No trip cancellation coverage and relatively low limit ($2,500) for trip interruption coverage

No coverage for preexisting medical conditions

- Up to $2,500 in coverage for trip interruption

- Up to $1,500 in coverage for trip delays of five-plus hours ($150 per day limit)

- Missed connection coverage worth up to $500

- Up to $2,500 in baggage insurance

- Baggage delay coverage worth up to $1,000 for delays of at least 12 hours.

- Up to $50,000 for emergency medical expenses ($500 for emergency dental sublimit)

- Up to $500,000 for emergency evacuation and repatriation of remains

- Up to $50,000 in accidental death and dismemberment (AD&D) insurance

- Up to $100,000 in protection for security evacuation

Provides coverage worth up to $250,000 for emergency medical expenses

Tailor other included benefit levels to your needs

Coverage only applies to trips up to 40 days

Deductible up to $100 applies for emergency medical coverage and baggage and personal effects

- Trip cancellation coverage worth up to between $2,500 and $10,000

- Trip interruption coverage worth up to 150% of the trip cancellation limit

- Up to $2,000 in trip delay coverage ($200 daily limit)

- Up to $1,000 in protection for missed connections

- Up to $250,000 in coverage for emergency medical expenses ($50,000 in New Hampshire)

- $750 dental sublimit within emergency medical coverage

- Up to $500,000 in coverage for emergency medical evacuation and repatriation of remains

- Up to $2,000 in coverage for baggage and personal effects

- Baggage delay coverage worth up to $1,000 ($100 daily limit)

- 24/7 travel assistance services

Get annual coverage for medical expenses and routine medical care

High limits for medical expenses and emergency medical evacuation

GeoBlue plans don't offer comprehensive travel protection

Deductibles and copays apply

- Ambulatory and therapeutic services

- Inpatient hospital services

- Emergency medical services

- Rehabilitation and therapy

- Preventive and primary care

Choose among three tiers of annual travel protection

Option for basic protection with affordable premiums

No coverage for preexisting conditions

Maximum trip duration of 30 days per trip

- Trip cancellation coverage up to $2,500 maximum per year

- Trip interruption coverage up to $2,500 maximum per year

- $200 per trip for trip delays (up to $100 per day for delays of 12 hours or longer)

- Up to $500 in coverage per trip for baggage and personal effects

- Baggage delay coverage up to $100 per trip

- Up to $10,000 for emergency medical expenses per trip

- Up to $50,000 in emergency medical evacuation coverage per trip

- Up to $10,000 in AD&D coverage

- 24-hour travel assistance services

Why Trust U.S. News Travel

Holly Johnson is a travel expert who has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world. On a personal level, her family uses an annual travel insurance policy from Allianz. Johnson works alongside her husband, Greg – who has been licensed to sell travel insurance in 50 states – within their family media business and travel agency .

You might also be interested in:

The 5 Best Family Travel Insurance Plans

Holly Johnson

Explore the options to protect your family wherever you roam.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

The 6 Best Vacation Rental Travel Insurance Plans

Protect your trip and give yourself peace of mind with the top options.

Is Travel Insurance Worth It? Yes, In These 3 Scenarios

Trip insurance isn't <i>always </i>necessary.

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

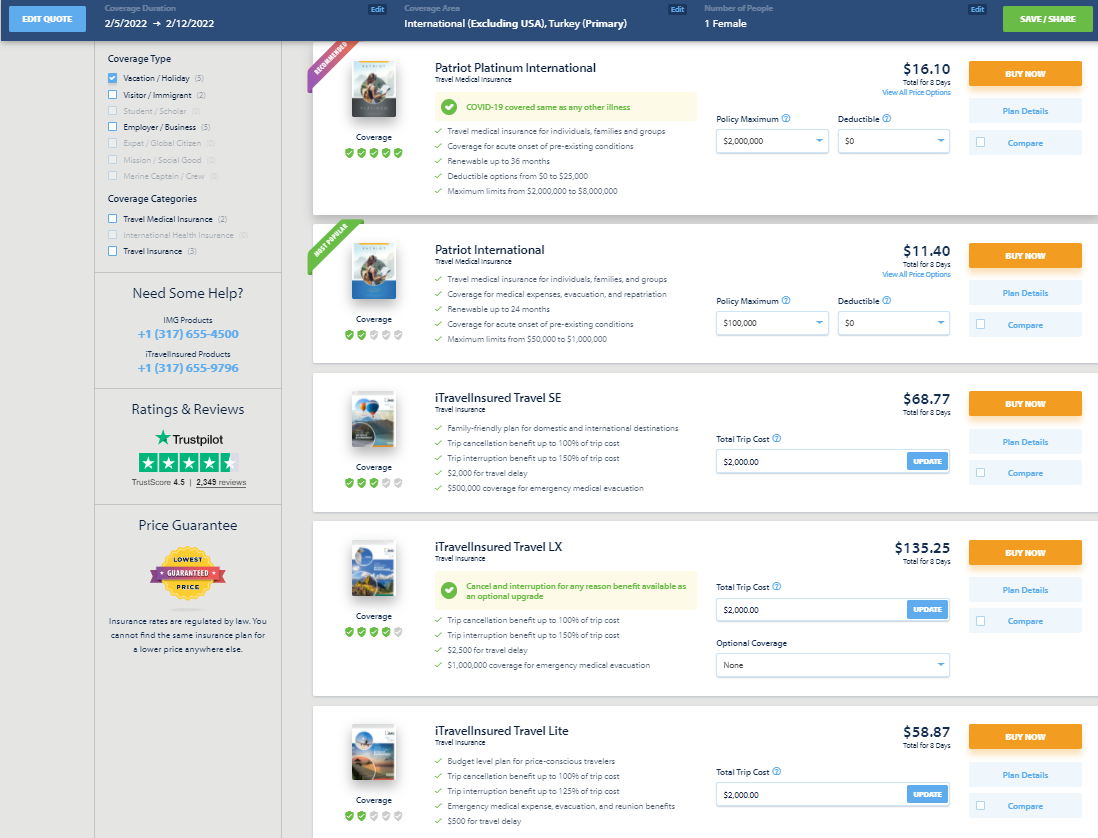

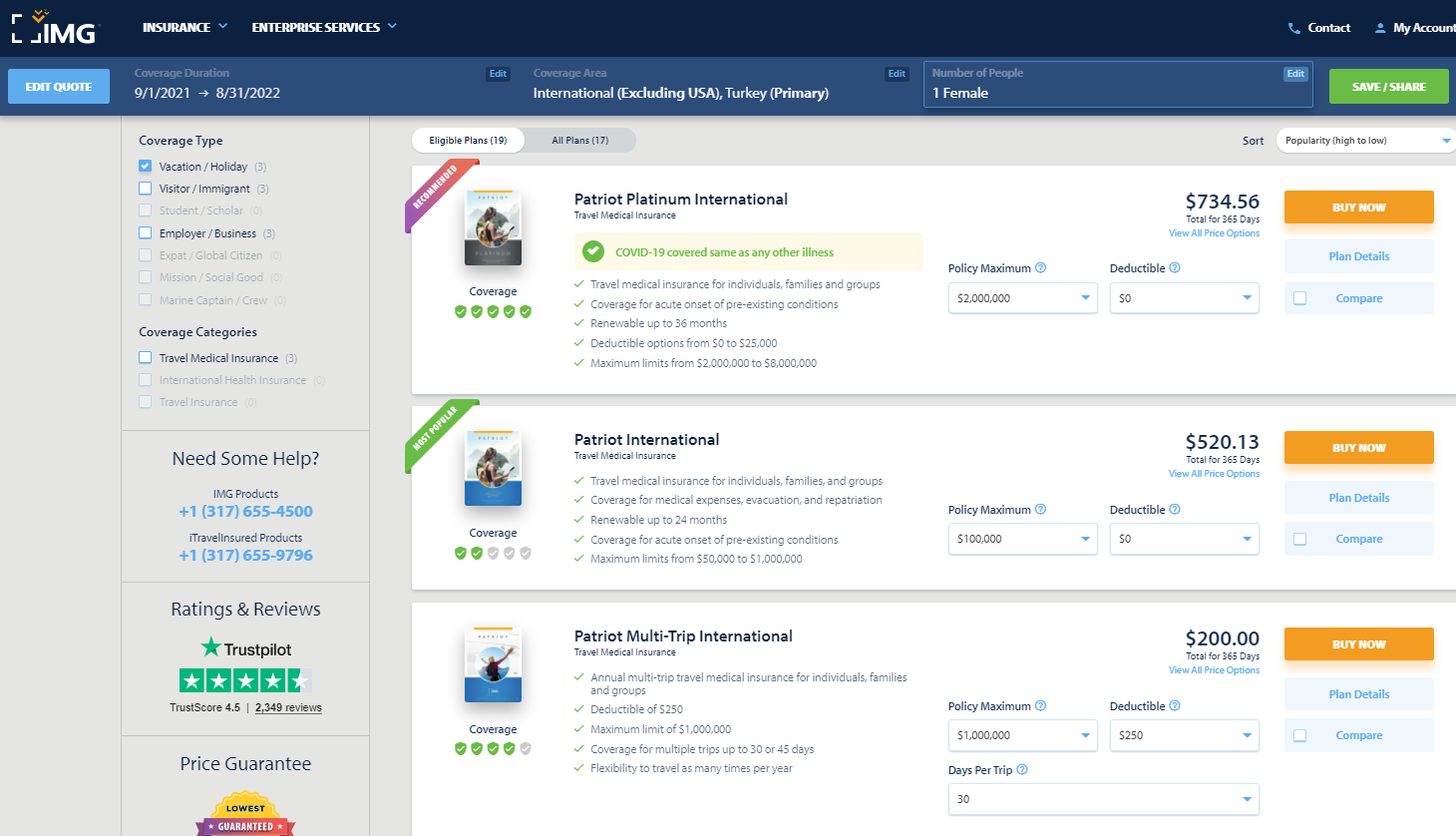

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

AIG Travel Guard

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

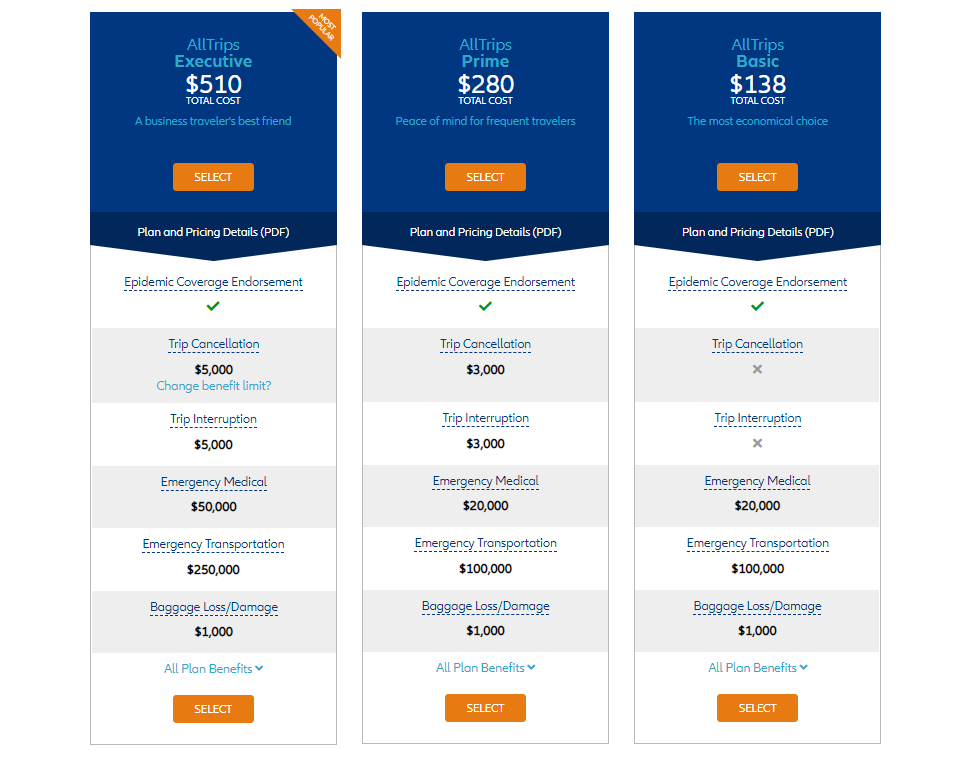

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

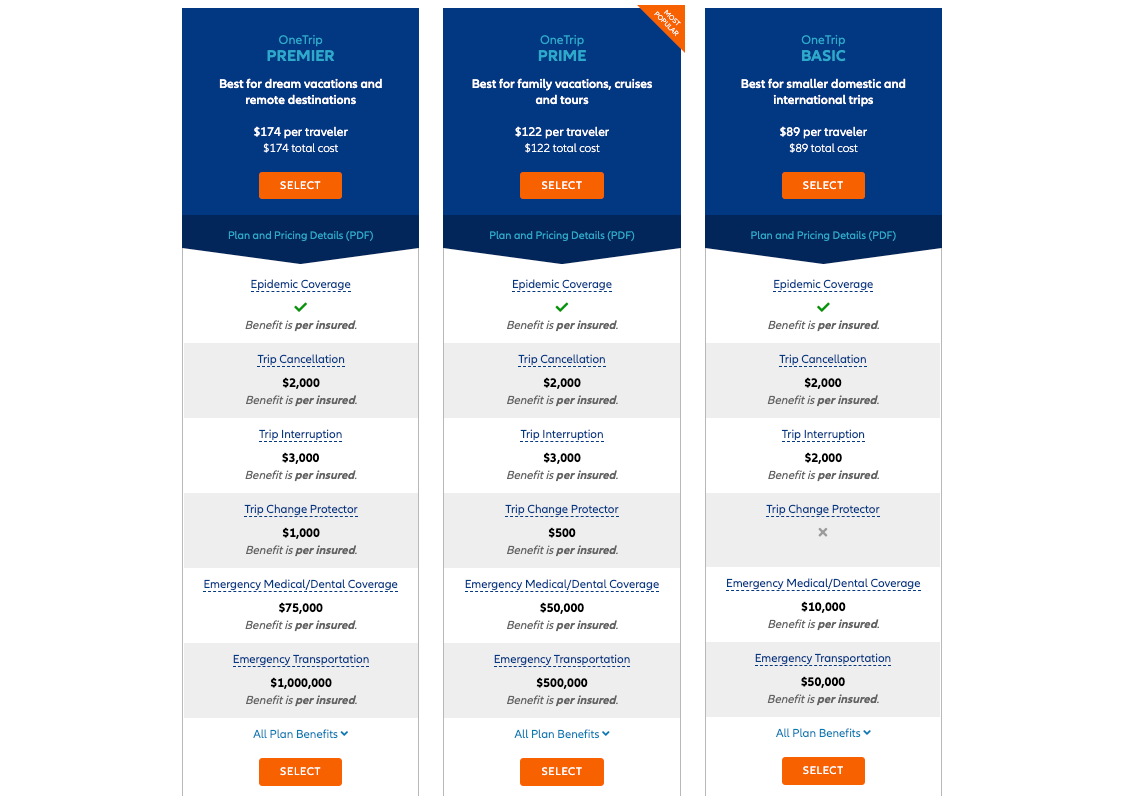

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

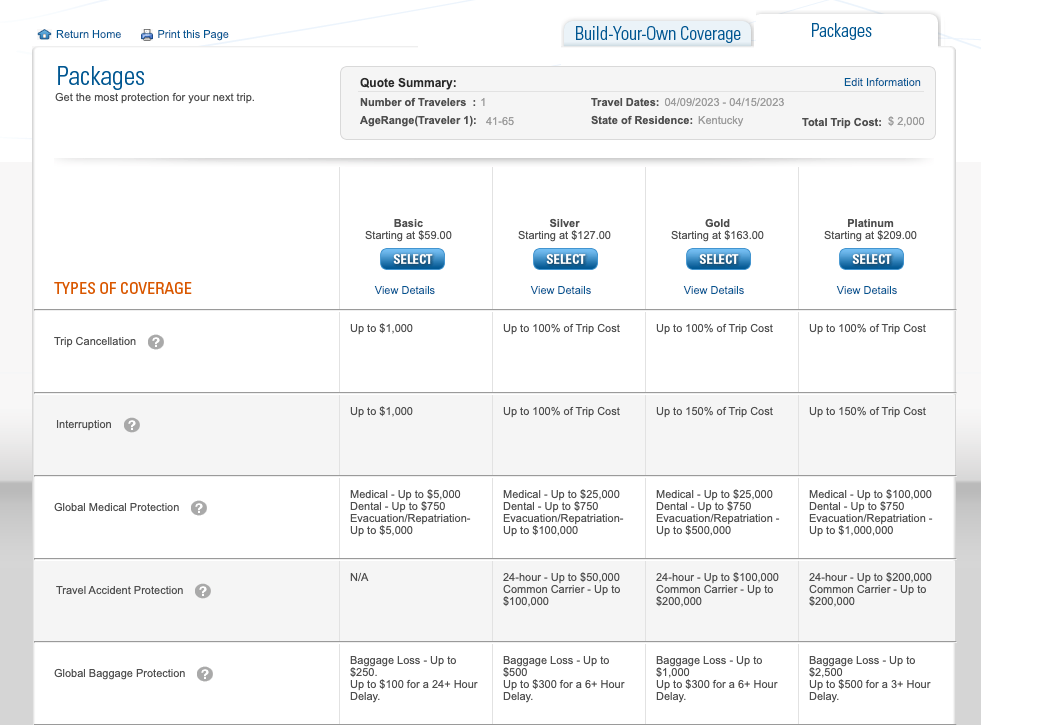

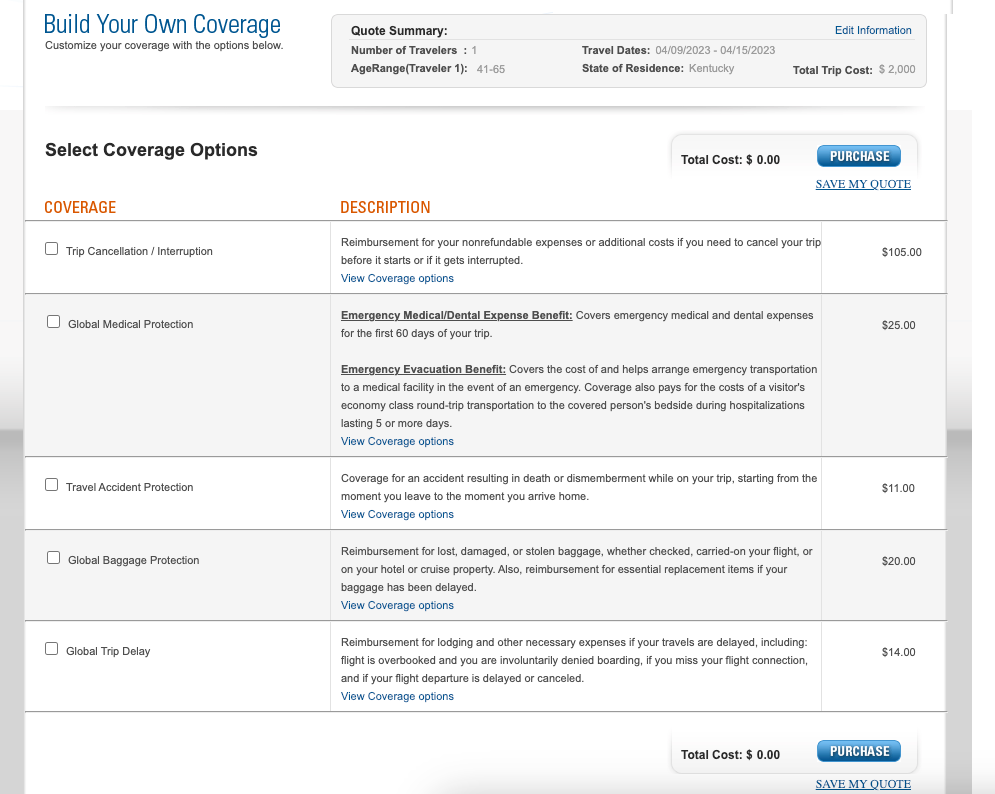

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

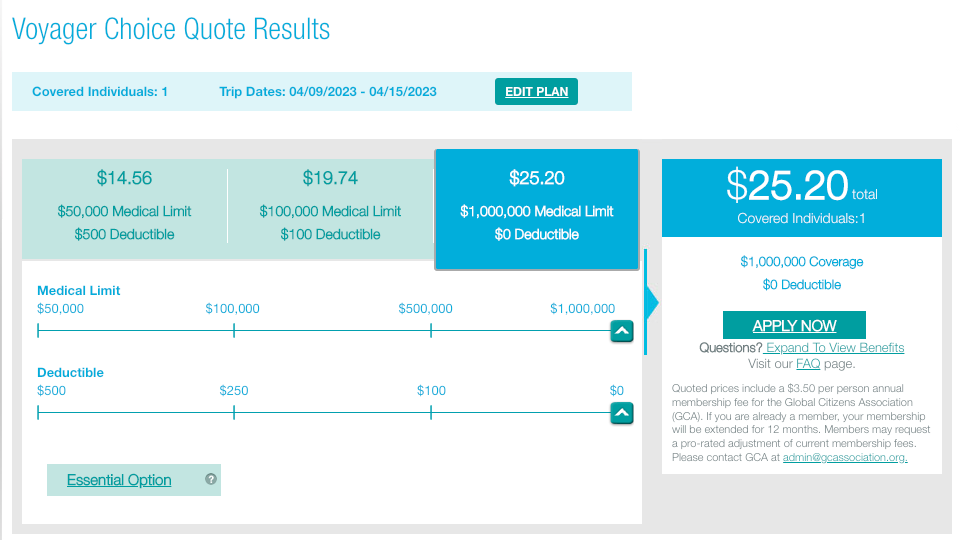

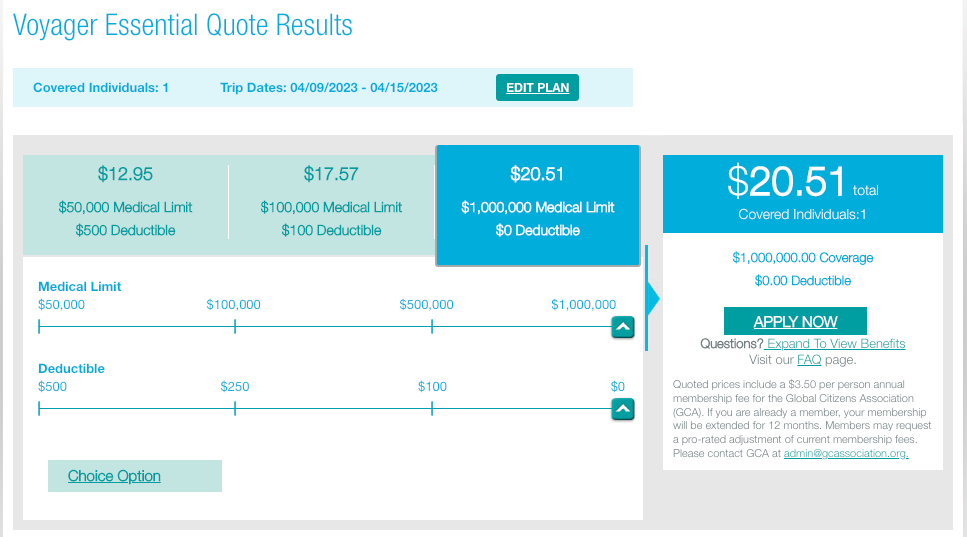

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

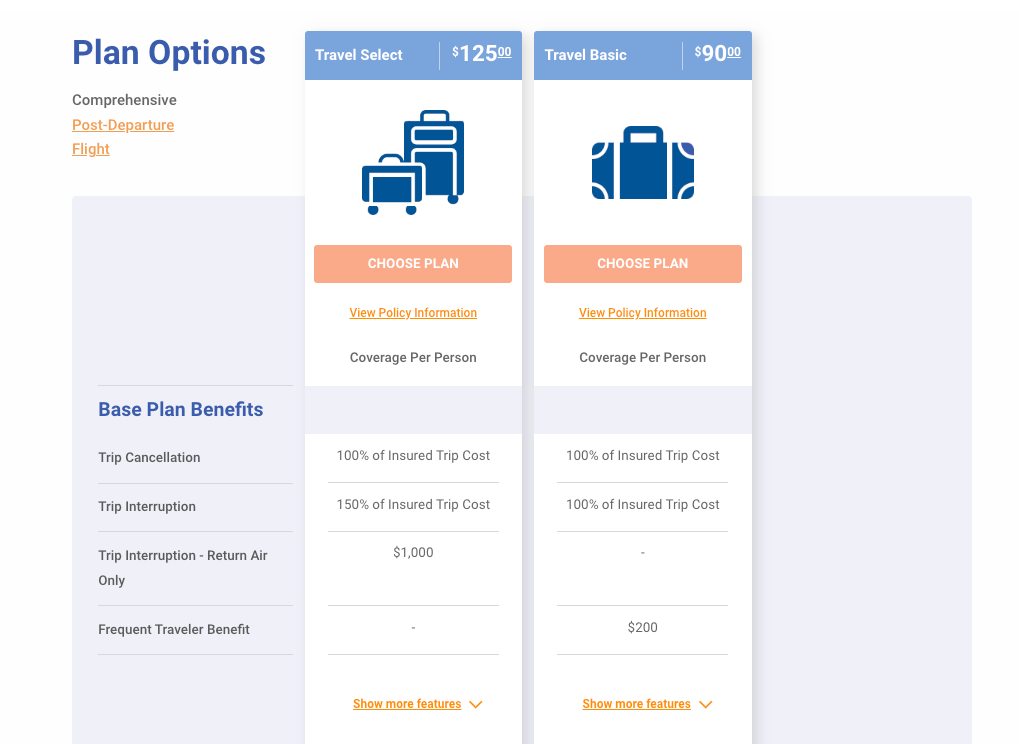

Travelex Insurance

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

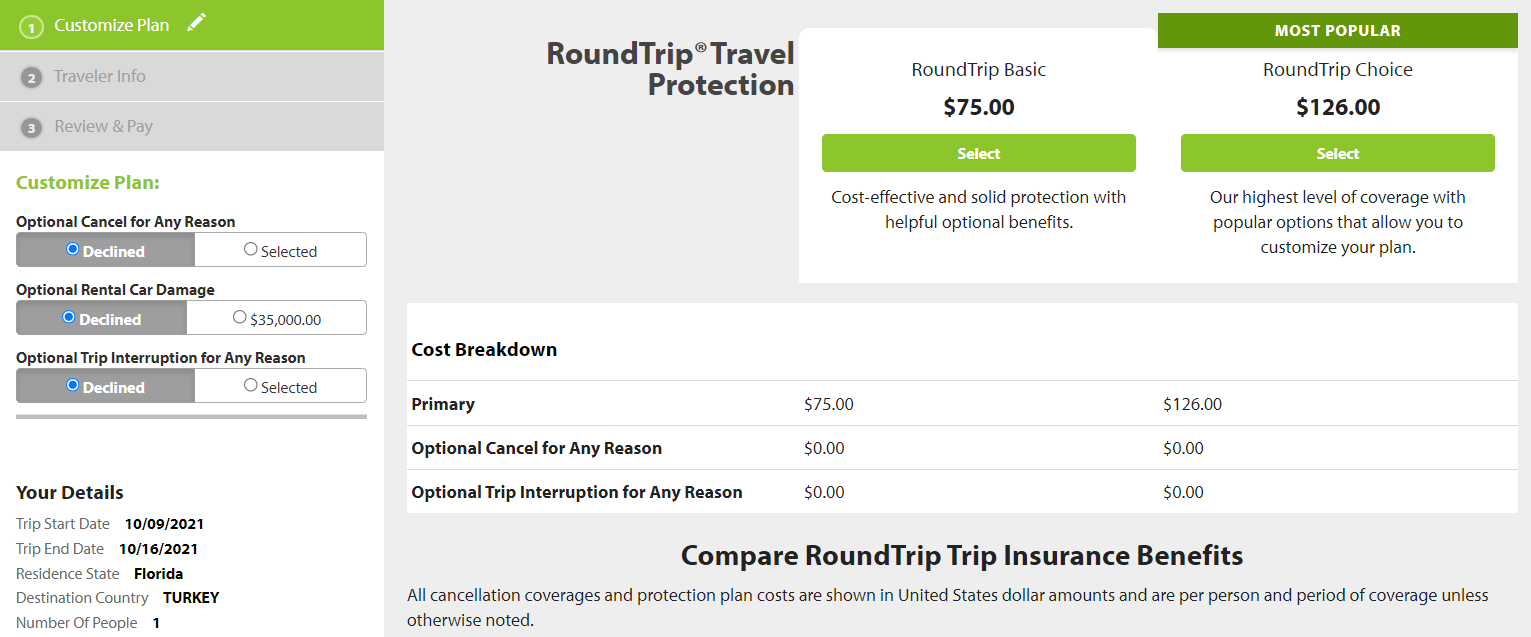

Seven Corners

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

Best Overall Travel Insurance

Best travel insurance runner-up, best travel insurance for cruises, best travel insurance for reputation, best travel insurance for pre-existing conditions, best travel insurance for digital nomads, best travel insurance for affordability, best travel insurance for road trips, best for adventure traveling, get travel insurance quotes, how we reviewed the best travel insurance companies, ultimate guide to choosing the best travel insurance.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate travel insurance products to write unbiased product reviews.

Traveling is an adventure, a leap into the unknown, a story waiting to unfold. But every story needs a safety net, and that's where travel insurance comes in. In this guide to the best travel insurance, we'll embark on a journey to help you better understand travel insurance and uncover the benefits that make it an indispensable companion for any traveler.

Best Travel Insurance Companies of 2024

- Best Overall: Nationwide Travel Insurance

- Runner-Up: AXA Assistance USA

- Best for Cruises: Travel Guard

- Best Reputation: C&F Travel Insured

- Best for Pre-existing Conditions: Tin Leg Travel Insurance

- Best for Digital Nomads: WorldTrips Travel Insurance

- Best Low-Cost Option: Trawick International Travel Insurance

- Best for Road Trips: Travelex Travel Insurance

- Best for Adventure Sports : World Nomads Travel Insurance

Best Travel Insurance Companies

The best travel insurance companies offer comprehensive coverage options for a wide range of people and needs. For this guide, we looked at coverage options, customizability, and the best companies for specific situations, such as pre-existing conditions.

Here are Business Insider's picks for the best travel insurance companies in 2024.

Nationwide Travel Insurance

Nationwide is of the largest players in the travel insurance space, offering nearly endless options for any customer on the travel spectrum, including annual travel insurance plans which can offer frequent travelers the flexibility to "set it and forget it" on their travel insurance coverage.

Nationwide Essential also offers some of the most affordable policies in the market compared to similar plans from competitors, which makes it a great pick for just about anyone. Buyers can discuss bundling options as Nationwide also sells homeowners, auto, pet, and other insurance products. Its travel insurance quoting is just as easy as it has been with other Nationwide insurance products.

Read our Nationwide travel insurance review .

AXA Assistance USA

AXA offers consumers a great option for no-stress travel insurance: low-priced plans, generous coverage limits on key categories including primary insurance on lost luggage, and up to 150% reimbursement for qualifying trip cancellations.

While add-ons are limited and rental car coverage is not included by default on cheaper plans, AXA is a perfect fit for travelers who don't plan to drive (or who already hold a travel credit card with rental car coverage), and don't need any additional bells and whistles.

Read our AXA Assistance USA travel insurance review .

Travel Guard

AIG is well-known insurance provider, and a great fit for travelers who want to ensure that they can get their money back in the event of canceled or interrupted travel plans.

While the company's policies can be pricey compared to its competitors, the high medical and evacuation limits make AIG a solid choice for older travelers who value peace of mind and simplicity over highly customizable plans that may be bolstered with medical upgrades.

Read our AIG Travel Guard travel insurance review .

C&F Travel Insured

While every travel insurance company has negative reviews about its claims process, C&F Travel Insured 's claims process has a consistent stream of positive reviews. One customer wrote that C&F processed a claim within 48 hours. Additionally, C&F regularly responds to customer reviews within one business week, making reviews a consistent way to reach the company.

Additionally, in C&F's fine print, it mentions that any claims that take more than 30 days to pay out will begin to accrue interest at 9% APY.

C&F's reputation isn't the only thing to speak highly of. It offers an array of add-ons uncommon in the travel insurance industry, such as Interruption for Any Reason insurance and CFAR coverage for annual plans. C&F also offers discounts for children on its Protector Edge plan and free coverage on its Protector plan.

Read our C&F Travel Insured review .

Tin Leg Travel Insurance

Tin Leg is a great fit for travelers with medical issues in particular. Seven of Tin Leg's eight travel plans include coverage for pre-existing conditions as long as you purchase your policy within 15 days of your initial trip payment.

Thanks to coverage for pre-existing medical conditions as well as for potential COVID-19 infection while traveling, this company offers some of the best financial investment options for travelers who are or will be exposed to higher health risks and issues.

Read our Tin Leg travel insurance review .

WorldTrips Travel Insurance

WorldTrips has affordable premiums, highly customizable add-ons, and generous coverage for core categories of travel insurance. All this makes it a great option for digital nomads, students studying abroad, and backpackers.

However, travelers should keep in mind that plans are not particularly flexible, and coverage amounts are limited unless you plan ahead to pay for the areas and amounts that you need.

Read our WorldTrips travel insurance review .

Trawick International Travel Insurance

Trawick offers low premiums across its five plans, most of which offer coverage for pre-existing conditions. You'll find robust medical travel insurance that can help higher-risk and anxious travelers find peace of mind while on the road. This company also offers high medical evacuation coverage limits, up to $1,000,000.

Additionally, Trawick's Travel Safe plan allows you to build your own plan from scratch, meaning you don't have to pay for coverage you don't need.

Read our Trawick travel insurance review .

Travelex Travel Insurance

Travelex offers three plans:

- Travel Basic

- Travel Select

- Travel America

The Travelex America plan is meant for trips limited to the U.S., but it has the highest coverage limits in many areas compared to its other programs. If you're flying somewhere, the lost baggage limits are higher. Its natural strengths shine for road trippers, though. Travelex America adds coverage for roadside service and rental car coverage for unexpected accidents. It also covers pets should you be involved in an accident while on the road.

While your standard auto insurance does extend to car rentals within the U.S. for a limited time, any accident would affect future rates. Travelex would eliminate the risk of reporting to your auto insurance provider for minor incidents within its purview.

Read our Travelex travel insurance review .

World Nomads Travel Insurance

World Nomads distinguishes itself from others by covering over 300 sports and activities, from skydiving to golf. Additionally, its one of the few travel insurance companies that allow you to purchase after departing for your destination. However, you'll have a 72-hour waiting period before coverage kicks in.

That said, World Nomads doesn't have the highest coverage limits compared to its competitors on this list, travel medical insurance capping out at $100,000. It also isn't the most flexible provider, only providing two plans to choose from with no options for pre-existing condition coverage. Yet, World Nomads still stands out for its sports coverage and post-departure coverage.

Read our World Nomads travel insurance review .

Introduction to Travel Insurance

Why travel insurance is a must-have.

The unpredictable nature of traveling – from flight cancellations to medical emergencies – can turn your dream vacation into a nightmare. Travel insurance acts as a personal safeguard, ensuring that unexpected events don't drain your wallet or ruin your trip.

Understanding Different Types of Travel Insurance

Not all travel insurance policies are created equal. From single-trip travel insurance policies to annual travel insurance plans , from minimal coverage to comprehensive protection, understanding the spectrum of options is your first step in finding the right fit for your journey.

Key Features to Look for in Travel Insurance Coverage

Travel insurance for medical emergencies.

Imagine falling ill in a foreign country; daunting, right? A robust travel insurance plan ensures you don't have to worry about how much emergency medical care while traveling will cost, even in the most remote corners of the globe. This coverage will often come in tandem with emergency medical evacuation coverage.

Trip Cancellation and Interruption Benefits

Life is full of surprises, some less pleasant than others. Trip cancellation and interruption coverage ensures that you're not left out of pocket if unforeseen circumstances force you to cancel or cut your trip short. You may also look for cancel for any reason and interruption for any reason options, which will reimburse you for a percentage of your nonrefundable fees, but expands the covered reasons you can cancel a trip. You can find our guide on the best CFAR travel insurance companies here.

Coverage for Personal Belongings and Baggage Loss

Losing your belongings is more than an inconvenience; it's losing a piece of your world. Insurance that covers personal belongings and baggage loss ensures that you're compensated for your loss, helping you to rebound and continue your adventure.

Support and Assistance Services

In times of trouble, having a lifeline can make all the difference. Look for insurance that offers 24/7 support and assistance services, giving you peace of mind that help is just a phone call away. Also, check websites that field customer reviews like Trustpilot, the Better Business Bureau, and InsureMyTrip , to see how well a company responds to customer requests.

Choosing the Best Travel Insurance

Reputation and reliability of the travel insurance provider.

A provider's reputation is not just about being well-known; it's about reliability, customer satisfaction, and the ability to deliver on promises. Researching and choosing a reputable provider is a cornerstone in ensuring your safety and satisfaction.

Understanding the Policy's Fine Print

The devil is in the details, and understanding the fine print of what your travel insurance policy covers is crucial. Be aware of coverage limits, exclusions, and the process for filing a claim to avoid any unpleasant surprises.

For example, to get coverage for a canceled trip due to work, many travel insurance companies require that you've been with that company for at least a year.

Customer Reviews and Feedback

In the age of information, customer reviews and feedback are goldmines of insight. Learn from the experiences of others to gauge the reliability and customer service of the insurance provider you're considering. While the ratings are important, you should also look at whether or not a company responds to customer complaints.

How to Get the Most Out of Your Travel Insurance

Knowing your policy inside out.

Familiarize yourself with every aspect of your policy — what it covers, what it doesn't, how to file a claim, and who to contact in an emergency. Being informed means being prepared. At the very least, you should have the terms readily available while you're on your trip.

Steps to Take When a Problem Arises

If you face an issue during your travels, knowing the immediate steps to take can make all the difference. Your insurance company may even have a 24/7 assistance hotline that can walk you through an emergency during your trip, even issues that don't involve claims.

When a problem arises. you'll want to document as much as possible, in case you need proof when filing a claim. Ask for receipts and invoices when possible.

How to Pick the Best Travel Insurance Company for You

There isn't a one-size-fits-all policy that works perfectly for every traveler. Young, healthy solo travelers can opt for much cheaper plans that offer bare-bones coverage, while families juggling complex itineraries will do best by investing in a robust policy that can help defray any costs associated with lost baggage, delayed transportation or other trip-impeding obstacles.